RORO Backtest Results

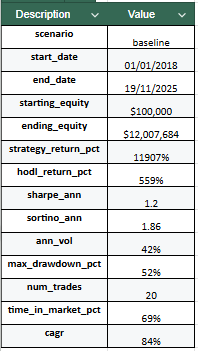

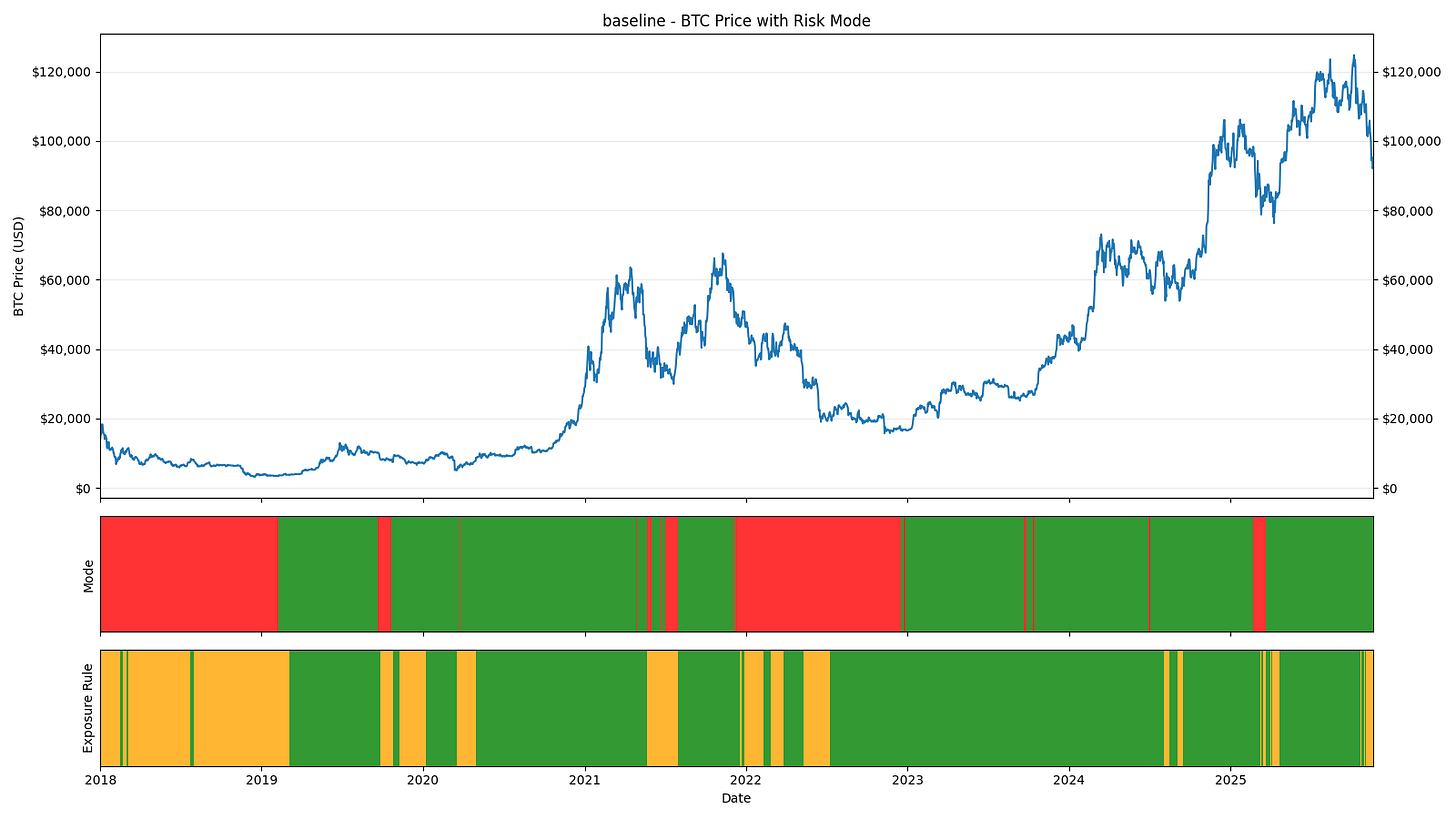

20 trades, 7 years, and a framework built to survive full cycles

Welcome 👋🏽

I’ve already laid out my medium-term view [1],[2],[3], and nothing has changed, so I won’t repeat what I’ve already said.

Last week I laid out the Capital Deployment Framework (CDF) which is there to help us size up near the lows.

Today, I’m sharing the back-tested results from the Risk-On Risk-Off (RORO) tool.

Strap in, this is a long one. If you’d rather skip the year-by-year breakdown, you can jump straight to the “Overall Summary” at the end.

I want to be clear upfront: I am not optimising for maximum percentage return.

In line with the philosophy of the RORO tool, my optimisation priorities, in order, are:

A low number of total trades

Minimal noise in the data and signals

Sharpe ratio greater than 1

High CAGR

Meaningful outperformance versus a BTC HODL strategy

Based on those objectives, I made modest adjustments to the RORO weightings. Nothing dramatic, just enough to optimise the tool without overfitting.

What do the results show?

Exactly what RORO is meant to deliver.

Significant outperformance versus HODL BTC: 11,907% vs 559%

Strong compounding: CAGR of 84%, well above the >30% goal I have set for my eToro portfolio.

Very low activity: 20 trades over ~7 years, or ~3 trades per year, primarily during major regime transitions

That trade count is a feature, not a bug. It reflects a system that stays invested during favourable regimes and steps aside only when conditions genuinely change.

Additional insight

A Sharpe of 1.2 and Sortino of 1.86 indicate that returns are not just high, but efficiently earned.

69% time in market strikes a strong balance between participation and capital protection.

The max drawdown of -52% is materially lower than BTC’s drawdowns over the same period, despite vastly higher returns. It occurred during the March 2020 COVID crash black swan event - the RORO tool is not designed to capture black swan events.

I expect to revisit and refresh these backtests every 6–12 months as new data becomes available and market structure evolves.

With that context set, let’s walk through the results in detail 👇🏽

Equity Curve

The equity curve shows that the RORO tool significantly outperforms a HODL BTC strategy.

Now, let’s look at how RORO and the Exposure Rule (ER) behaved over the last seven years.

Assumptions

We take profits into euphoria, in line with predefined take-profit (TP) levels, as shared on Substack in late 2024, early 2025, and late 2025.

As a result, we hold cash on the sidelines, ready to redeploy when RORO flips from Risk-Off 🔴 to Risk-On 🟢.

We avoid frequent in-and-out trading.

Definitions

Mode:

🟢 when RORO is Risk-On

🔴 when RORO is Risk-OffExposure Rule (ER):

🟡 when either Macro or Crypto (typically Crypto) is fully 🔴, meaning 0% in the RORO tool

🟢 in all other cases

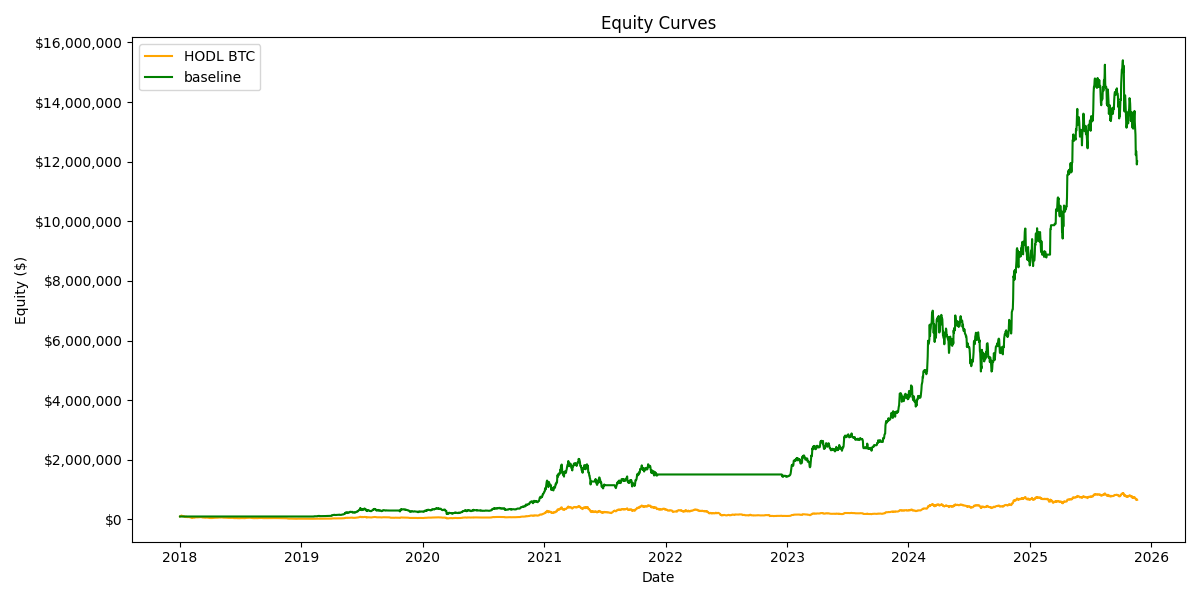

2018 Signal

RORO stayed Risk-Off for all of 2018, correctly classifying it as a single prolonged bear market rather than a series of tradeable swings - capital preservation in action.

The ER remained mostly 🟡, confirming persistent bearish crypto momentum. Brief 🟢 periods were short-lived and lacked durability, signalling relief rallies rather than regime change.

Bear-market rallies were deliberately ignored. RORO + ER prevented premature re-entry and avoided repeated drawdowns from false recoveries.

Regime persistence was the key insight. Once Risk-Off locked in, it stayed locked in until conditions genuinely improved. Macro, not price, was the missing ingredient.

Summary:

RORO decides if we should be invested, ER determines how much confidence to place in crypto momentum. In 2018, the framework did exactly what it was designed to do, protect capital for the next true Risk-On regime.

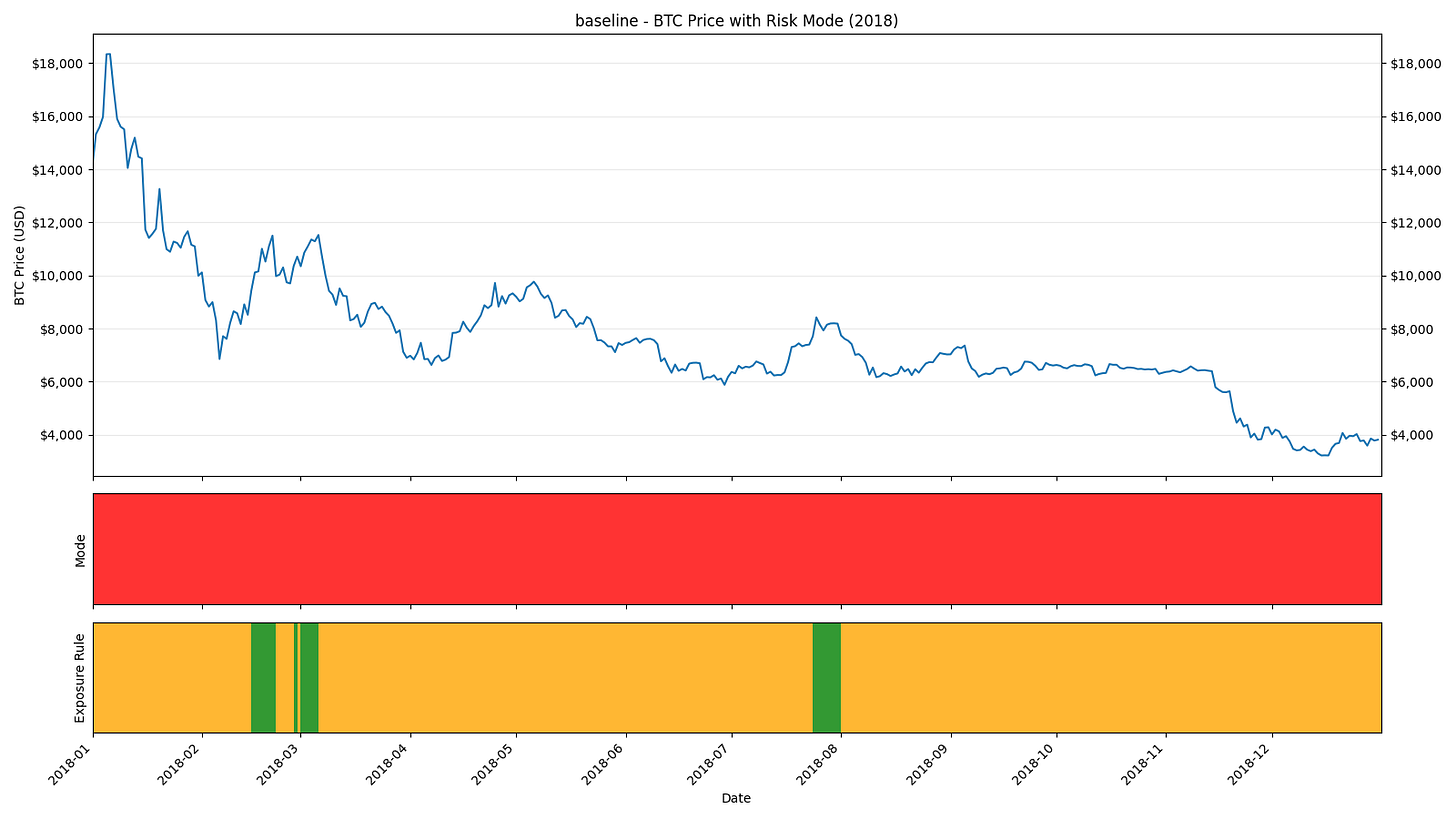

2019 Signal

RORO flipped to Risk-On at what was effectively the bottom in 2019. BTC was ~3.4K at the time.

My view:

this is the time to allocate.

The ER turned 🟢 shortly after RORO, confirming that the rally was supported by durable crypto momentum rather than a fragile bounce.

The first half of 2019 was a clean Risk-On phase, with RORO and ER staying supportive throughout the move from ~$3k to ~$12k, despite normal pullbacks.

As momentum deteriorated later in the year, RORO flipped back to Risk-Off at $10.2K and ER flipped to 🟡 at $8.4K, reducing exposure while price was still elevated. BTC ultimately bottomed at $6.4K.

My view:

In this context, reallocation should be driven by either the Capital Deployment Framework (CDF) or a clean flip in RORO from 🔴 to 🟢.

One key realisation from this analysis is that after prolonged periods of RORO staying 🟢, the first appearance of 🔴 often signals that more downside is still ahead, even if RORO subsequently returns to 🟢. We see this pattern repeatedly (April 2021, December 2021, June 2024, and February 2025). These early Risk-Off signals tend to mark the start of regime stress.

Summary:

2019 demonstrates RORO + ER participating in recovery phases while stepping aside when momentum and macro weakens.

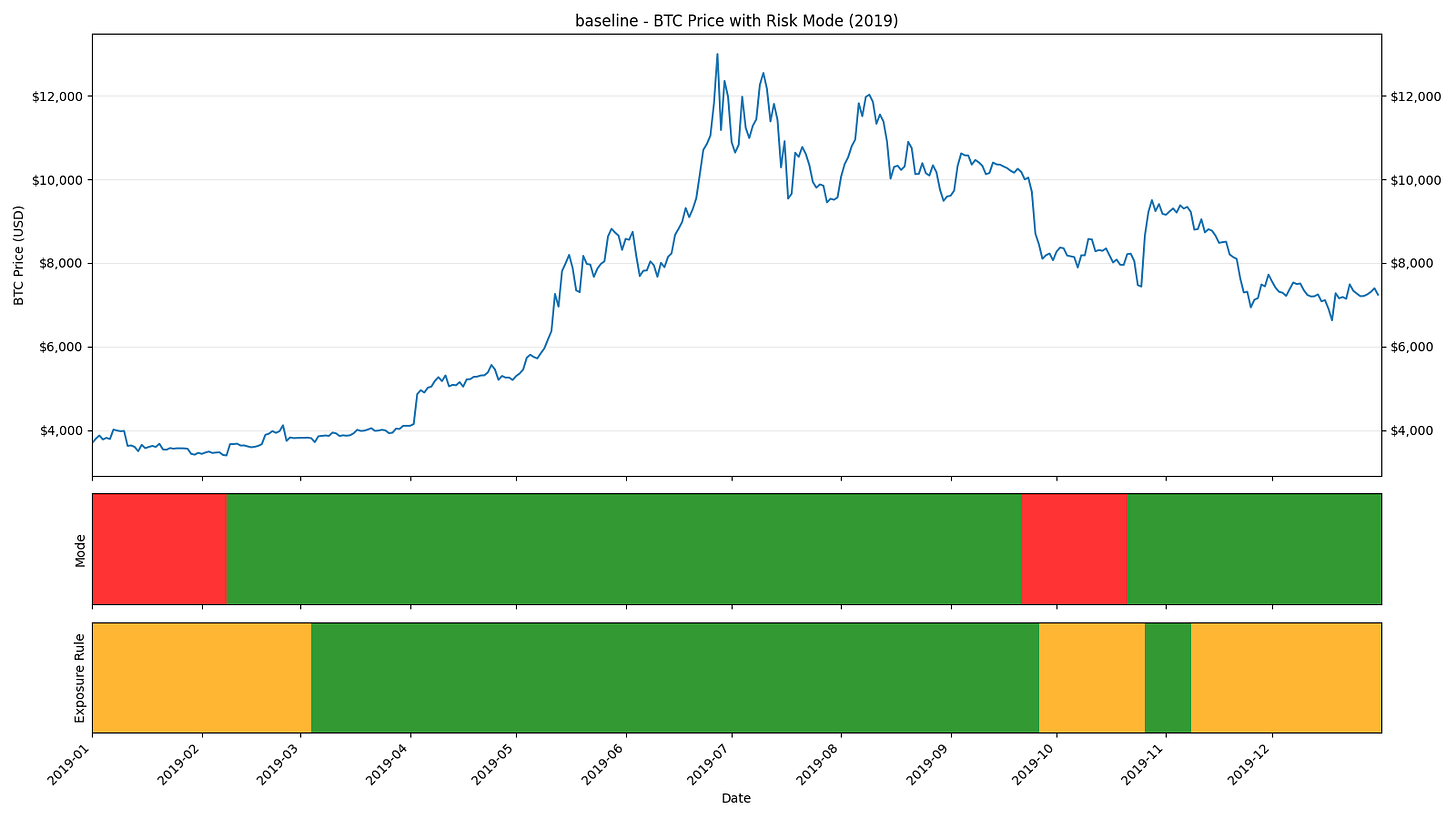

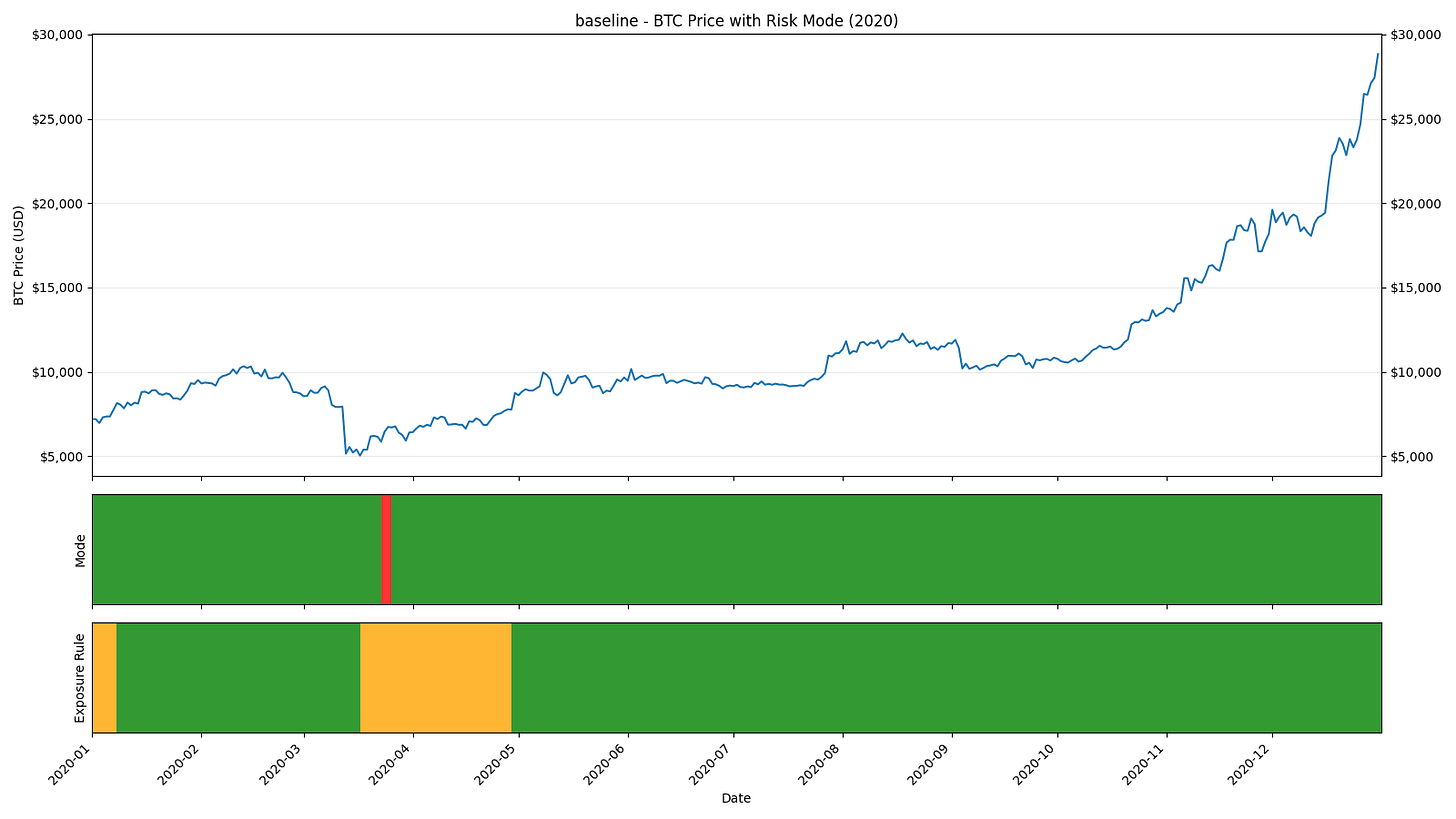

2020 Signal

RORO classified the March COVID crash as a shock, not a new bear market. Risk-Off was brief and did not persist, avoiding the 2018-style sidelining. It is important to note, that RORO is not designed to get us out during black swan events.

My view:

We could use the RORO tool strictly, but for many of us, there are tax implications to consider when selling assets. On this basis, and for this example, I would not be cutting exposure following a black swan event, but rather adding exposure.

The ER temporarily flipped to 🟡

My view:

This is my first realisation that the ER is best used as confluence, signalling when momentum is deteriorating or returning, rather than as a hard exit trigger.

That said, when price is near ATHs and momentum breaks down (see late 2025), the ER becomes particularly powerful. In that context, it acts as an early warning system, allowing risk to be managed before a full regime change occurs.

Used this way, there is no need to wait for the ER to flip back from 🟡 to 🟢 in order to allocate. Allocation decisions should remain primarily driven by RORO, with ER modulating conviction when conditions are extended.

It’s also worth noting that this period does not include RORO #14 – BTC ETF flows, which would likely have flipped much earlier and provided additional confirmation.

Once conditions repaired, RORO flipped back to Risk-On early, with ER confirming stabilised momentum well before price made new highs.

From mid-2020 onward, RORO and ER stayed firmly 🟢, allowing uninterrupted participation in the move from ~$7K to ~$30K.

Summary:

2020 validates RORO + ER as an accurate regime framework, staying aligned with liquidity-driven expansions (key period of money printer go BRRRR) rather than reacting to price fear.

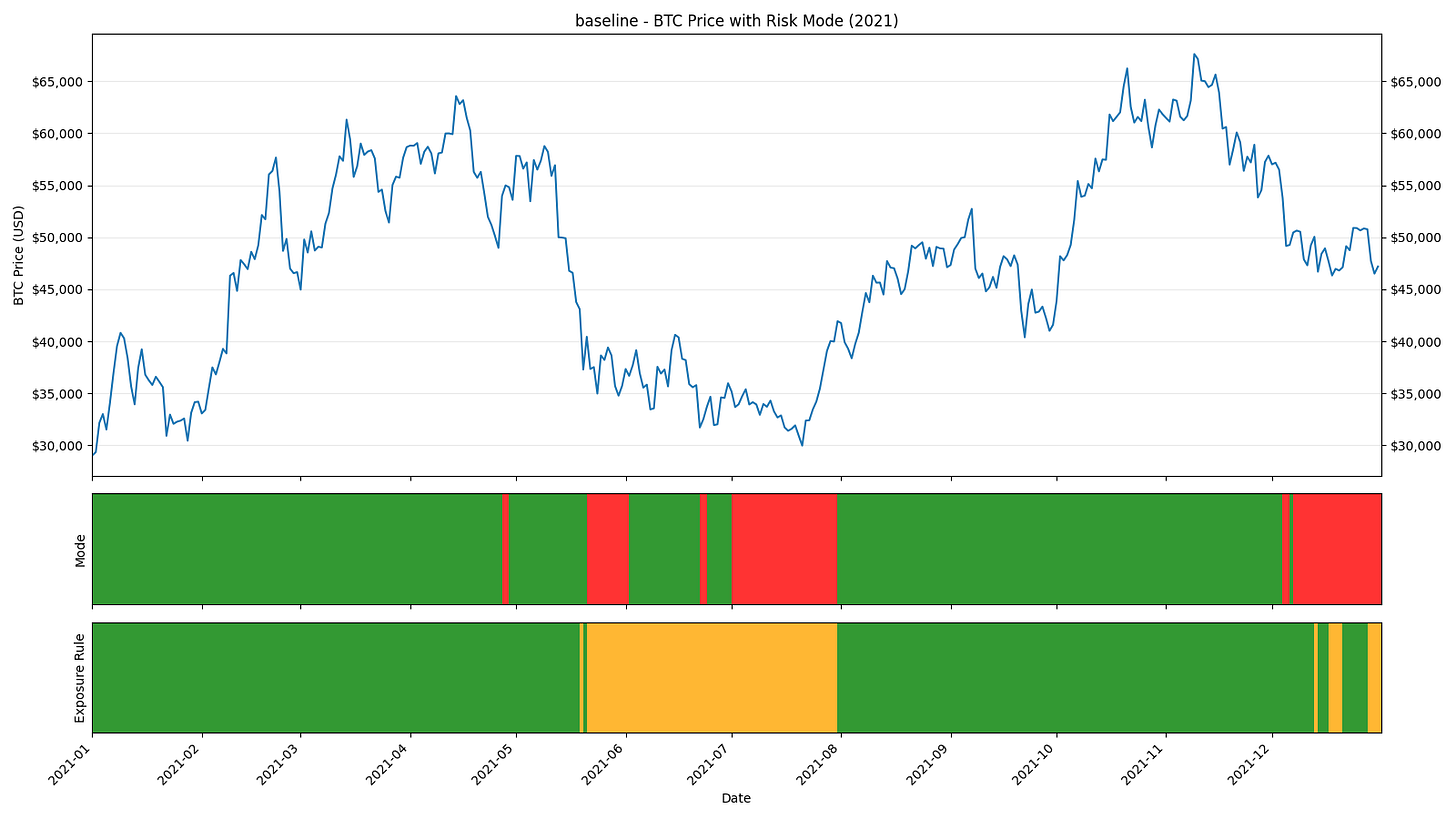

2021 Signal

RORO remained Risk-On for most of 2021, correctly staying aligned with supportive macro liquidity and a late-cycle bull market rather than fighting the trend.

The May 2021 crash was flagged as crypto-specific damage, not a full macro regime break. RORO briefly flickered Risk-Off, while the ER flipped to 🟡 and stayed cautious for an extended period.

My view:

Example 2 (April) and 3 (December): after prolonged periods of RORO staying 🟢, the first appearance of 🔴 often signals that more downside is still ahead, even if RORO subsequently returns to 🟢.

As conditions genuinely improved into Q4, ER and RORO flipped back to 🟢, allowing participation in the final move to new highs.

Late in the year, both RORO and ER deteriorated while price was still elevated (~$54K), signalling regime decay ahead of the 2022 bear market.

Summary:

2021 shows RORO + ER managing late-cycle risk, staying invested while conditions justified it, moderating exposure during structural damage, and stepping back before the regime fully failed.

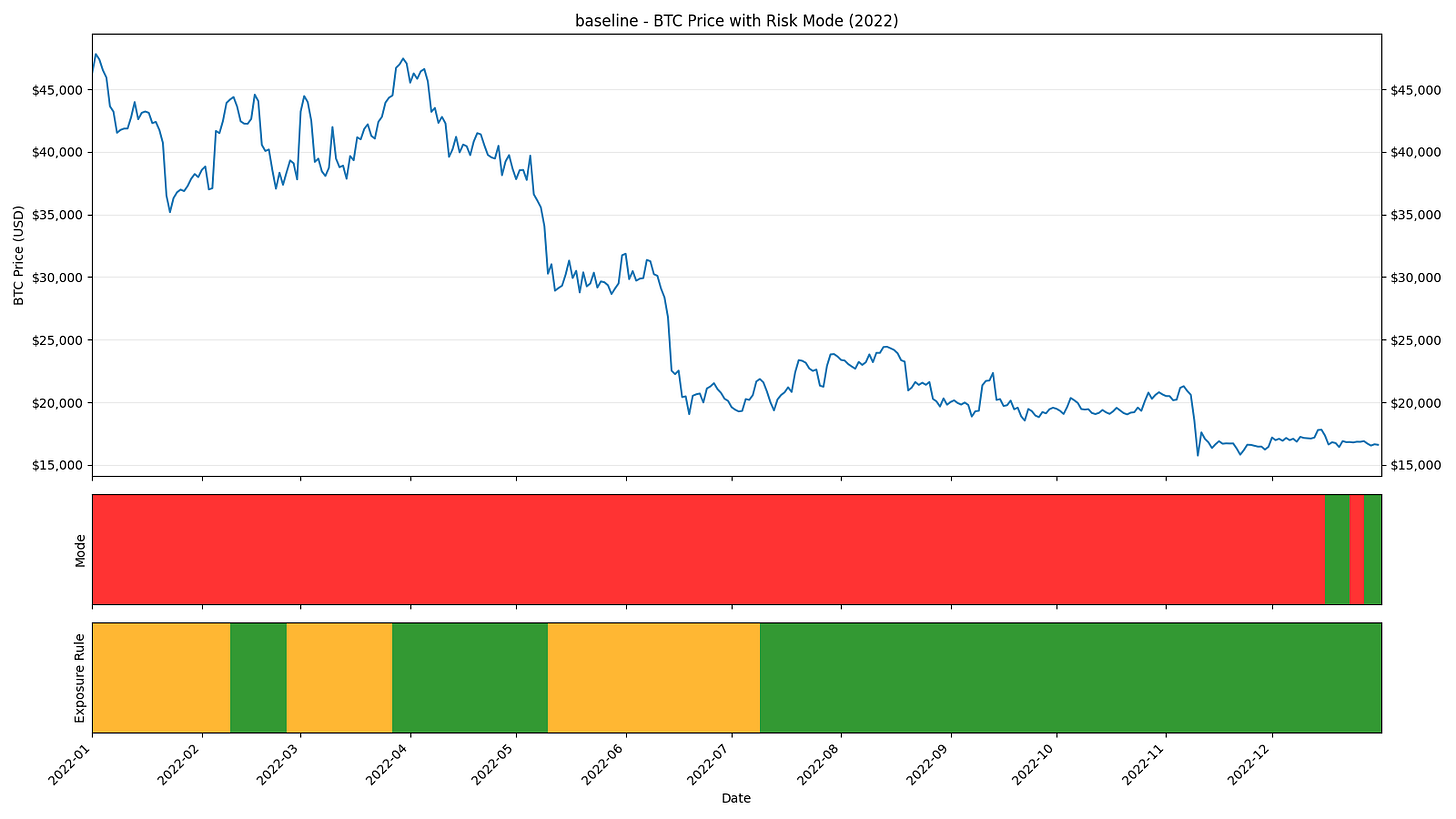

2022 Signal

RORO flipped Risk-Off early and stayed there for almost all of 2022, correctly identifying a structural macro-driven bear market rather than a series of tradeable drawdowns.

The ER oscillated early in the year, briefly turning 🟢 during relief rallies, but repeatedly degrading to 🟡 as crypto momentum failed to sustain.

Major crypto failures (Terra Luna, 3AC, etc) were confirmations of an already broken regime. The framework was defensive well before these events.

Mid-to-late 2022 saw ER stabilise 🟢 while RORO remained 🔴, reflecting improving crypto structure inside a still-hostile macro environment.

My view:

The first flip of RORO from 🔴 to 🟢 in December 2022 is the signal to allocate meaningfully, effectively positioning us near the cycle lows.

Summary:

2022 demonstrates RORO + ER at its most disciplined, staying Risk-Off through macro tightening, filtering false recoveries, and prioritising capital preservation over premature re-risking.

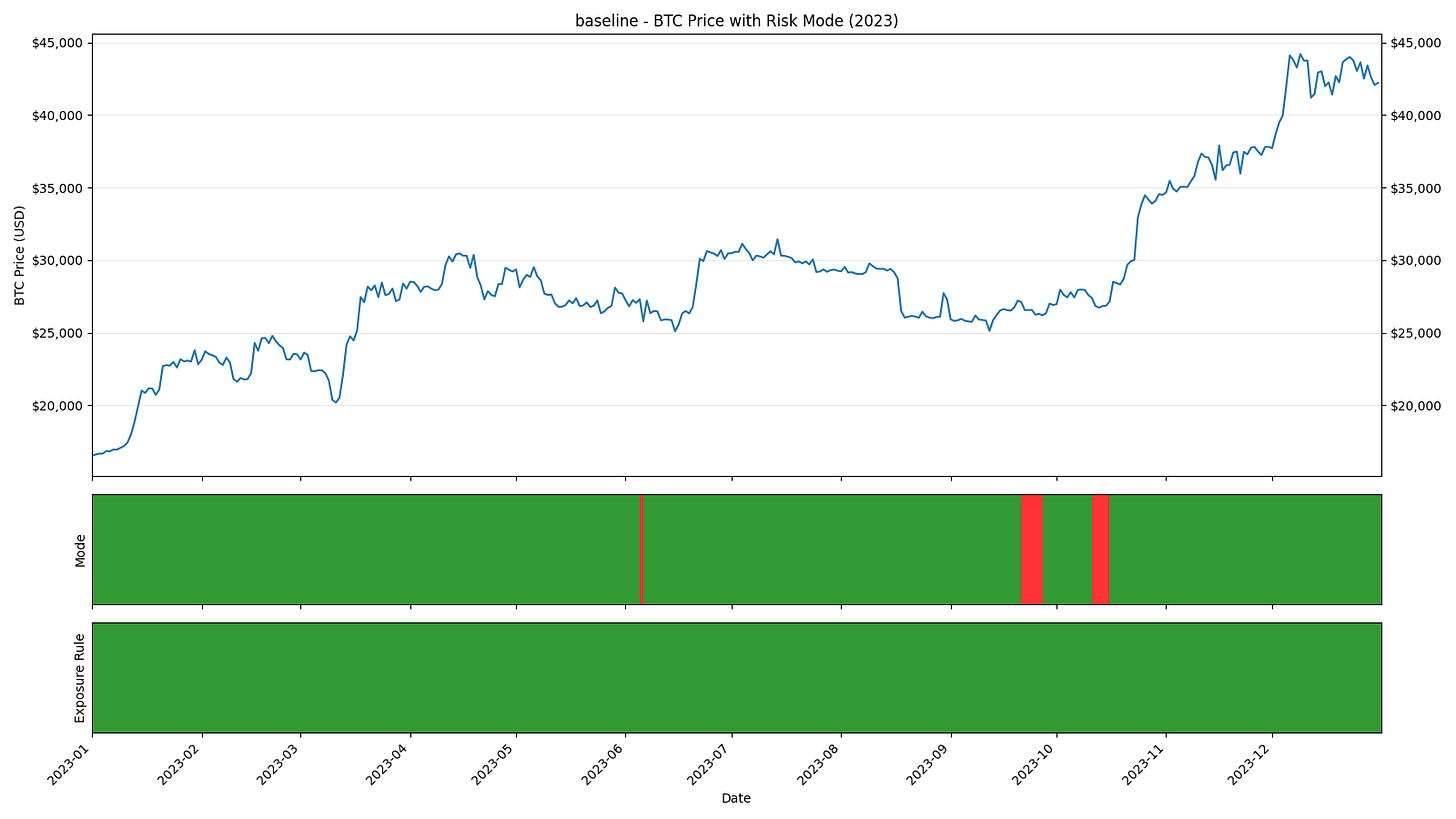

2023 Signal

RORO was already Risk-On in late 2022 and stayed there.

The ER remained 🟢 the entire year, confirming durable crypto momentum through pullbacks, consolidations, and mid-year volatility.

Major stress events (i.e. the banking crisis in March 2023) were absorbed, not destabilising. RORO and ER did not flip Risk-Off.

Brief RORO flickers did not persist, while ER stayed supportive, correctly treating them as noise within an early-cycle bull regime.

My view:

Early in a bull run, I would treat most RORO flips from 🟢 to 🔴 as noise, depending on what actually caused the flip.

If the trigger is crypto-specific momentum indicators (RORO #10–#14), it is generally not concerning. However, if the flip is driven by global liquidity (RORO #1–#2) or global interest rate conditions (RORO #3), it carries far more weight and warrants caution.

Summary:

2023 validates RORO + ER as an early-cycle framework, re-engaging before consensus (that the bull market is back), staying aligned with improving structure, and rewarding patience while others remained anchored to the 2022 trauma.

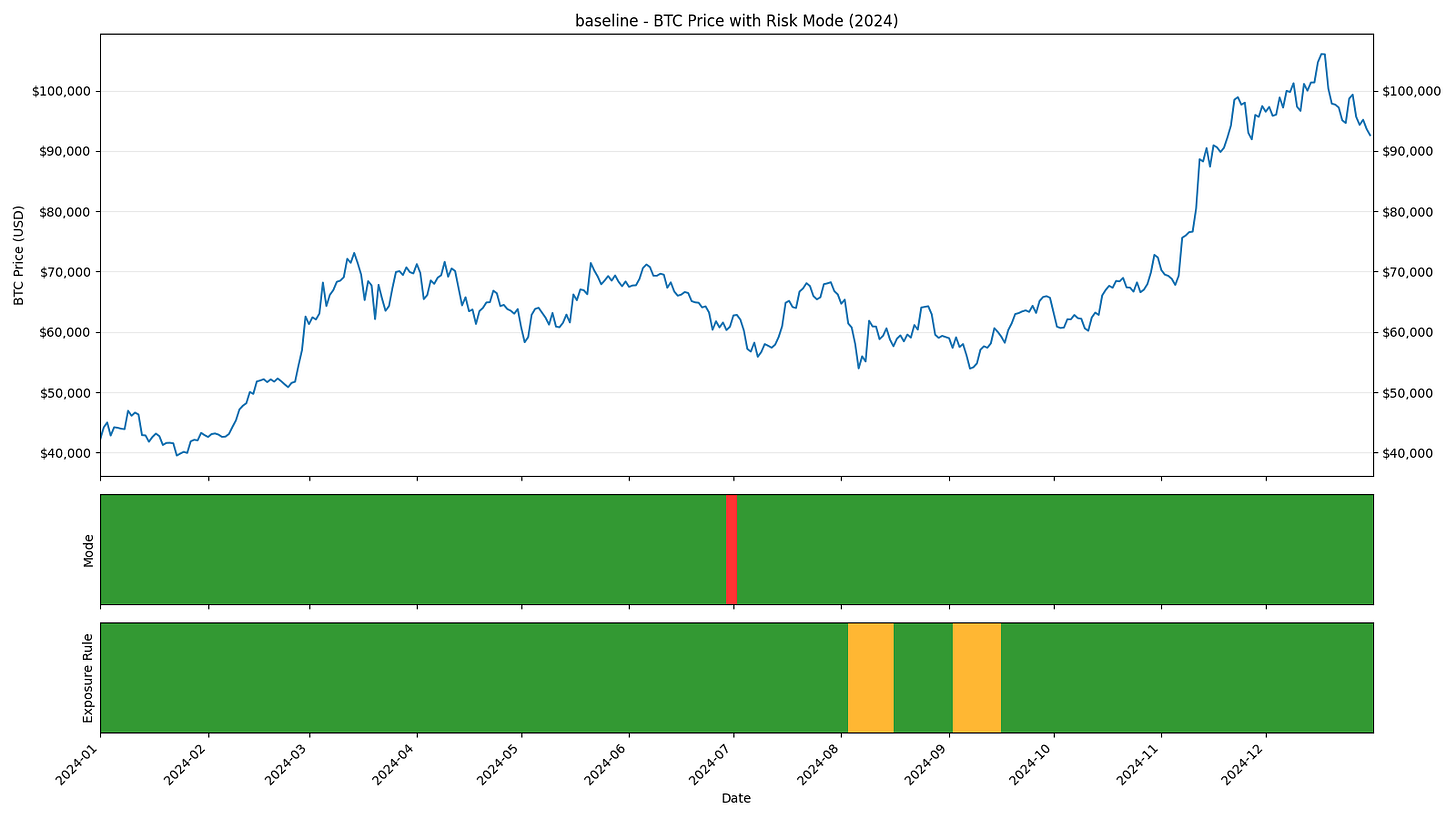

2024 Signal

RORO stayed Risk-On throughout 2024, correctly treating the year as a continuation and acceleration of the regime that began in 2023, not a new signal.

The ER remained mostly 🟢, with only brief 🟡 periods during consolidation, signalling slowing momentum rather than structural breakdown.

Extended sideways price action was absorbed (especially in the face of the “Yen carry trade unwind,” which turned out to be a nothing burger), not treated as a regime failure. Macro and liquidity conditions remained supportive, keeping exposure intact.

The late-year breakout validated patience, with ER quickly returning to 🟢 before this. There was no need for reactive re-entry or chasing.

Summary:

2024 demonstrates RORO + ER at its most patient, maintaining exposure through consolidation, filtering noise, and staying aligned with a mature bull regime where the biggest risk was being shaken out, not being long - much like we’re experiencing today.

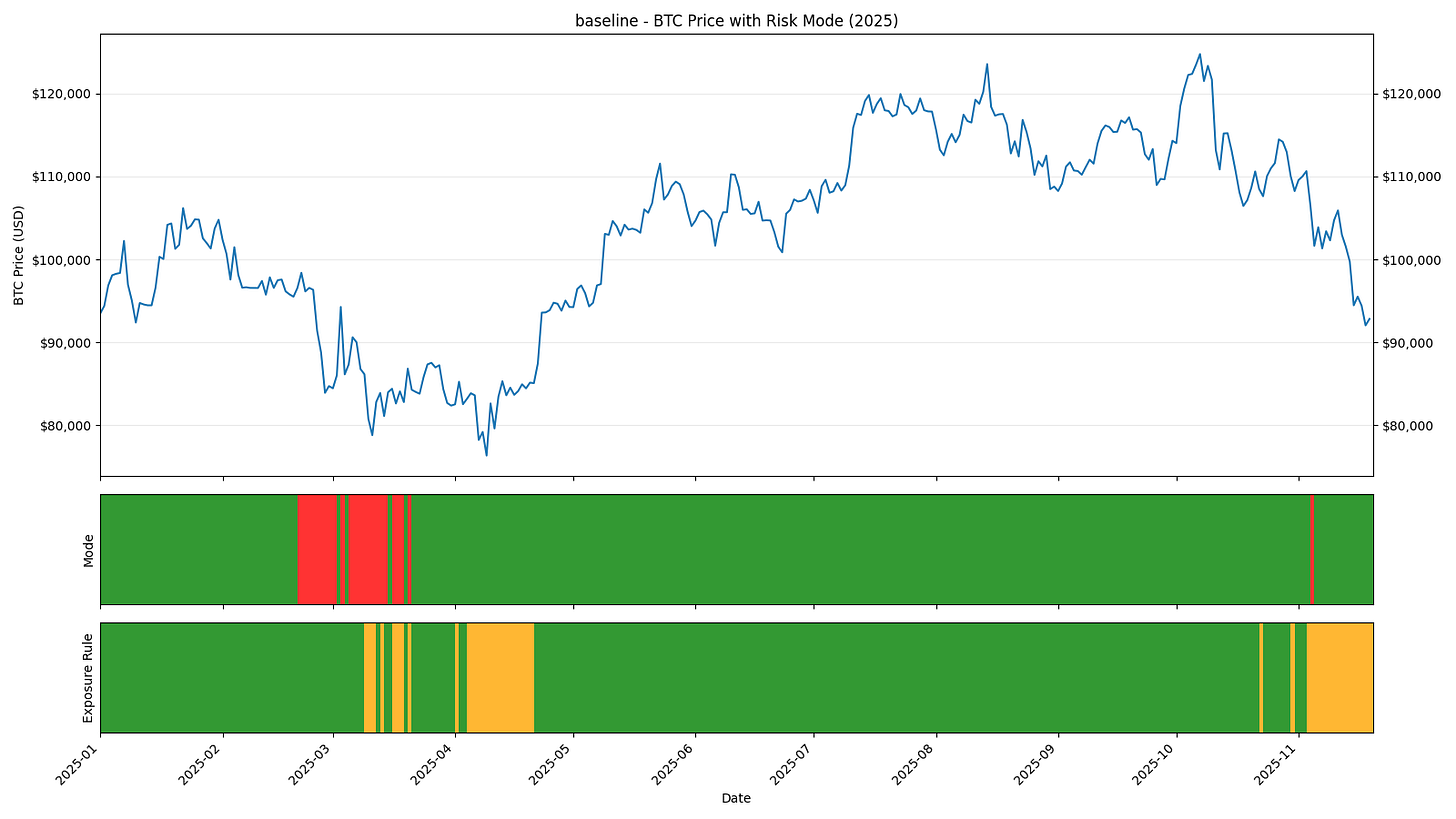

2025 Signal

RORO stayed broadly Risk-On in 2025, but with increasing instability. RORO flipped Risk-Off in February 2025 (when BTC was at $96.5K) signalling a weakening macro regime rather than a clean continuation like 2023–2024.

Early-year volatility exposed fragility, with ER temporarily flipping to 🟡 as the market struggled to absorb sharp drawdowns driven by Trump Tariff policies.

Late-year flip of RORO and ER was the key warning.

My view:

Example 4 (April 2025) and 5 (November 2025): after prolonged periods of RORO staying 🟢, the first appearance of 🔴 often signals that more downside is still ahead, even if RORO subsequently returns to 🟢.

On top of using ER as confluence of a trending bear or bull market, this is how I want to use the ER: when price is near ATHs (i.e. within 20%), and momentum begins to break down, indicated by ER flipping to 🟡, it serves as an early warning signal to reduce risk exposure.

For example, ER flipped to 🟡 on 22 October, when BTC was ~$108.5K, highlighting emerging momentum deterioration while price was still elevated.

Summary:

2025 marks a shift from trend participation to risk management. RORO still permits exposure, but ER clearly signals shrinking momentum, favouring reduced conviction, tighter risk control, and preparation for a potential regime break.

Overall Summary

Core framework

RORO decides whether we should be exposed at all.

Exposure Rule (ER) determines how much confidence to have while exposed.

The most interesting state is RORO 🟢 + ER 🟡. When this appears in late-cycle environments (i.e. late 2025) near ATHs, it signals rising fragility rather than an immediate regime failure.

How ER should be used

ER should not be applied symmetrically across the cycle.

It is most effective as a late-cycle tactical overlay, not during early recoveries or depressed price environments where noise dominates.

When prices are extended (i.e. close to ATHs) and ER degrades, consider reducing exposure and at the very least, tightening circuit breakers.

How RORO should be interpreted

After prolonged periods of RORO staying 🟢, the first appearance of 🔴 often signals further downside ahead, even if RORO later returns to 🟢.

Early in a bull run, most flips from 🟢 to 🔴 should be treated as noise, depending on what actually caused the flip.

If we do not have any other considerations i.e. tax, then RORO should be used explicitly. Even with those considerations, RORO should be used unless there is sound reasoning for why it is being disregarded.

Reallocation rules

Reallocation should be driven by either the Capital Deployment Framework (CDF) or a flip in RORO from 🔴 to 🟢.

RORO remains the primary Risk-On Risk-Off switch. ER acts as a conditional modifier when conditions become stretched.

With that out of the way, let’s see the current state of the RORO tool👇🏽