Start From the Assumption It’s All Noise

A framework for surviving Trump, tariffs, and Twitter

Welcome 👋🏽

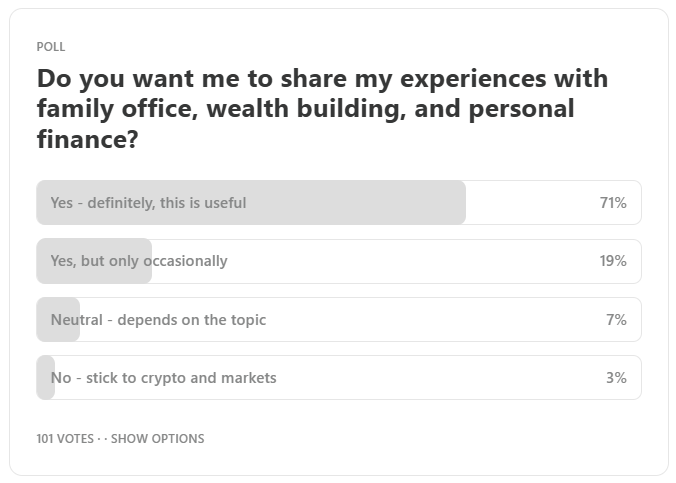

Thank you to the 100 folks who voted in last week’s poll 👇🏽

About 90% said they want at least some content related to family offices, wealth building, and personal finance.

That’s a relief because a lot of my time is spent in those areas, and I genuinely enjoy discussing them.

That said, I’ll save that content for when there’s actually something worth digging into properly.

Signal vs Noise

This week, I want to talk about dissecting signal from noise.

How do we actually do that?

I think it’s a skill in itself. The framework that helps me most is starting from the assumption that it’s all noise.

Pessimistic, I know, but if we’re being honest, for every one unit of signal, there are probably 99 units of noise in the media.

From there, we dissect:

Does this actually matter?

Take the recent video from FED Chair Jerome Powell. It sent social media into a flurry.

Around the same time, I posted a somewhat bullish take on eToro (about something unrelated) and was met with concern👇🏽

Was there anything in the video that was not common knowledge?

No.

For months, it’s been clear that POTUS has been:

➡️ trying to influence interest rates

➡️ putting pressure on Powell

➡️ using public tactics to force his hand (remember the Fed renovation visit and attempted humiliation?)

This wasn’t new information. It was noise, and the markets reflected that the very next trading day

📈 NASDAQ: +0.08%

📈 SPX: +0.16%

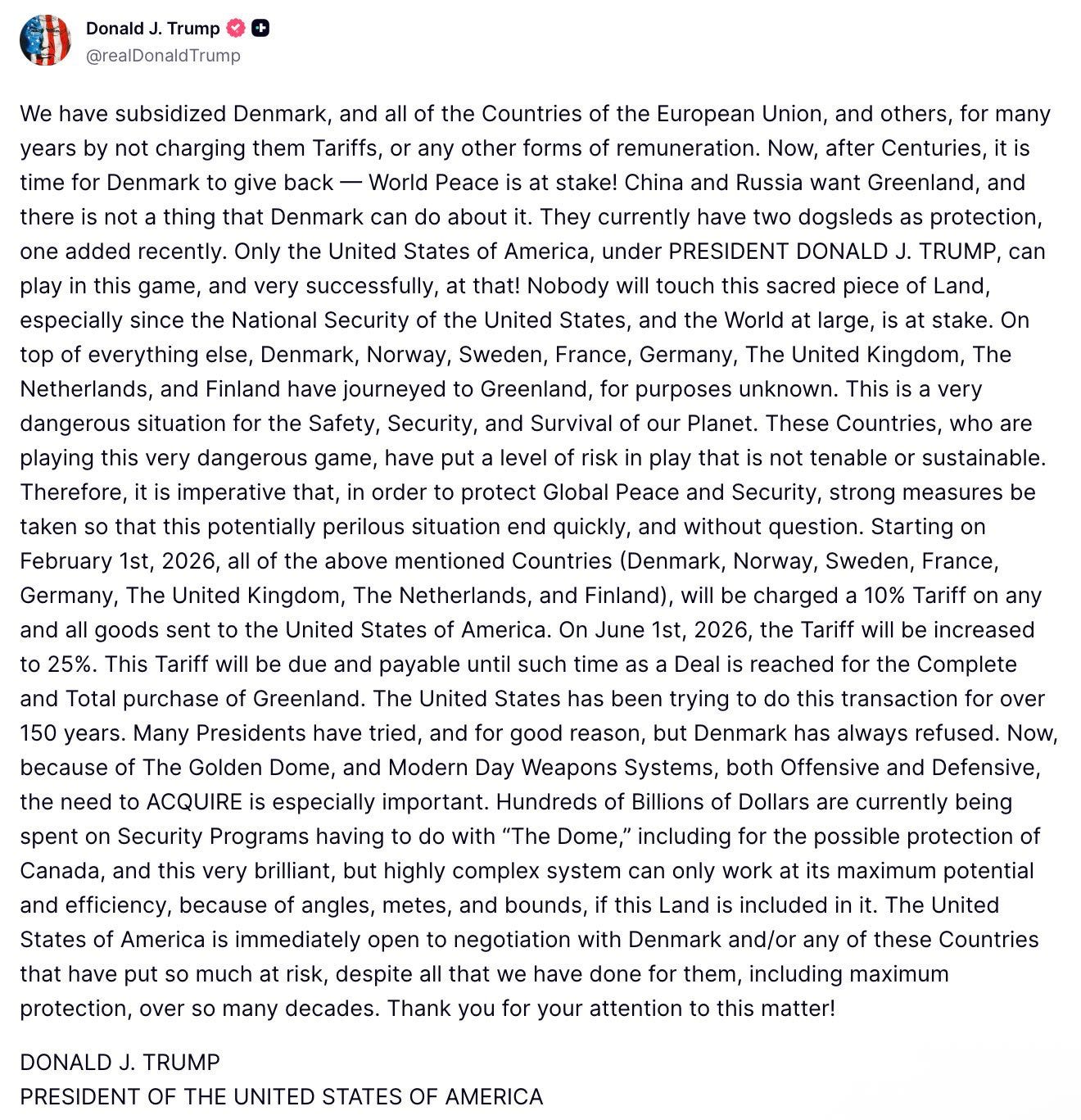

The Greenland tariffs panic (again)

Fast forward a few days, and now we have POTUS saying certain NATO allies will face additional tariffs because they “dared” meet in Greenland to discuss how to respond to increasing pressure from POTUS.

So once again, I default to the same question:

Does this actually matter?

Not from my perspective.

This is the same playbook we’ve seen since Trump 2.0.

Trump uses tariffs:

as a negotiation tool

as a pressure lever

as punishment when a country or leader steps out of line

It’s headline volatility, and as I said in my 2026 outlook:

Volatility is expected, but structural drawdowns should be buyable, not the start of a new bear market.

If this were a meaningful shift in policy trajectory, we’d see it reflected across risk assets, FX, and rates.

Let’s check.

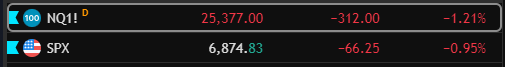

Risk Assets:

NASDAQ futures: -1.2%

SPX futures: -1.0% (with markets closed)

That’s barely outside the norm for a Trump presidency.

Or to put it another way, we’re basically flat (-0.11%) on the year….

FX:

DXY: +0.17%.

A complete nothingburger.

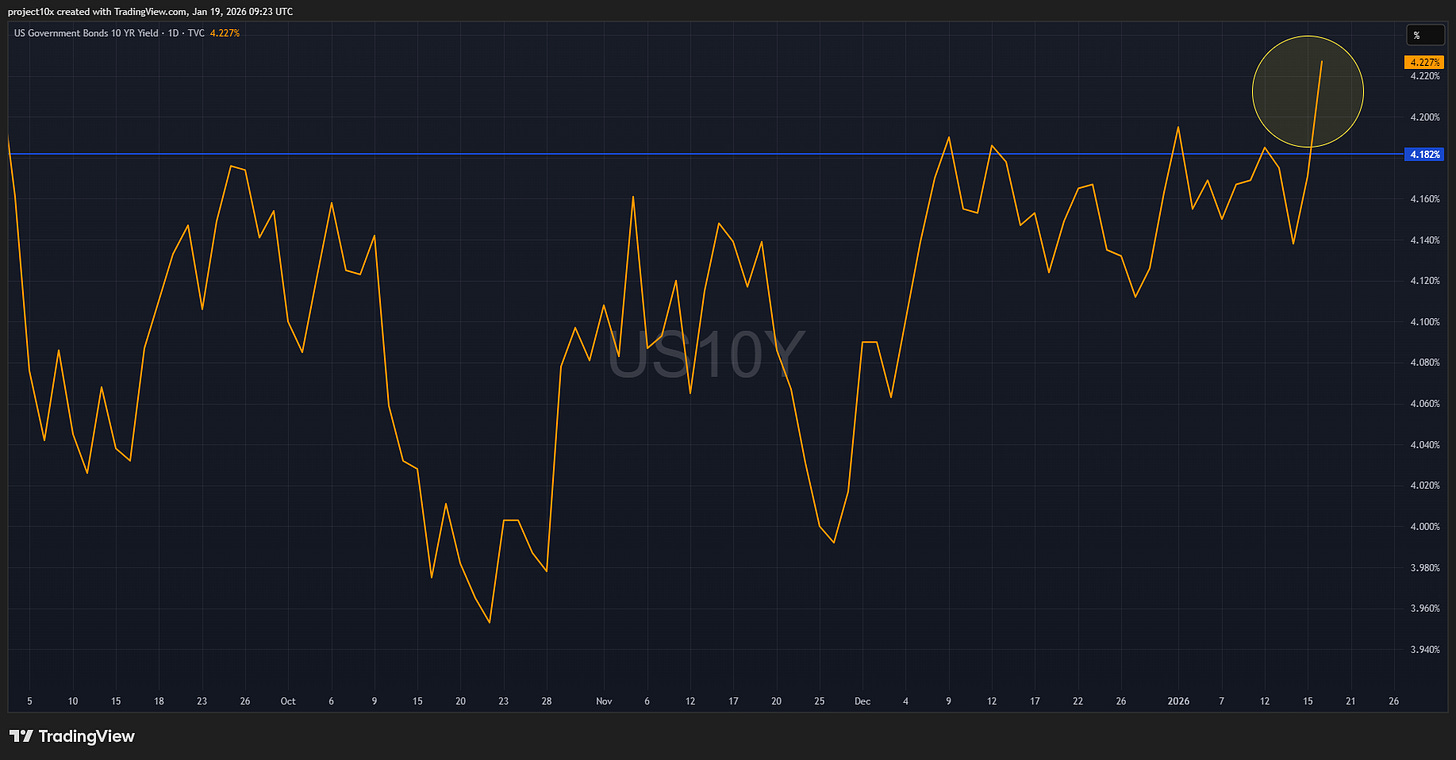

Rates:

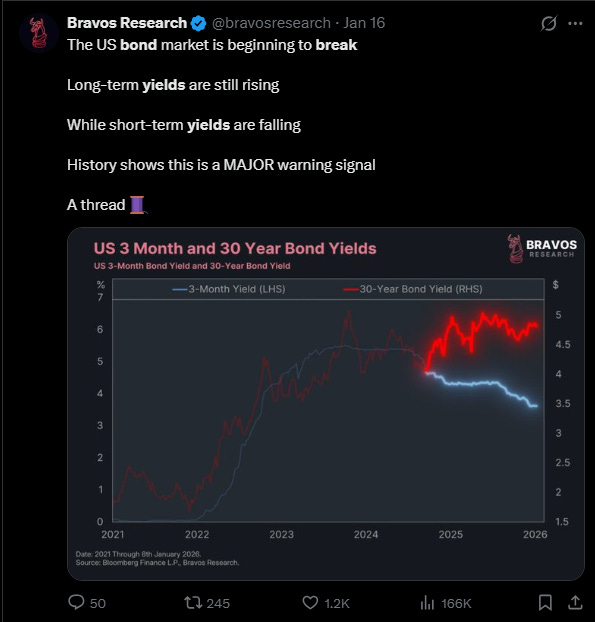

This is what has got X riled up 👇🏽

The long-term bond yields (in this case, the US 10Y) have broken through a multi-month resistance level.

Long-term bond yields (in this case, the US 10Y) have broken above a multi-month resistance level.

And of course, every key opinion leader on X is like….

👇🏽

But maybe, just maybe, we should zoom out.