The institutions beat the normies to it...again! 😂

You can bring a horse to water but it'll probably just kill time on TikTok

Welcome 👋

This week’s newsletter is probably the most important one I release this year.

Today I cover:

The Institutions are here 🧑💼🏦

The FED gives stocks the green light 🟢🚥

But first, let’s kick things off with some headlines that make you wanna go

⚠️ DISCLAIMER ⚠️

The content provided by PROJECT 10X PTY LTD (Filip Brnadic) is for educational purposes only and is not financial or investment advice. PROJECT 10X PTY LTD is not a licensed financial adviser under Australian law.

Investing involves risk, including the potential loss of all funds. Seek independent advice before making any financial decisions.

Headlines

The UK government passed legislation to make the country a crypto hub

Thailand's 2nd largest bank, "K-Bank" buys local crypto exchange.

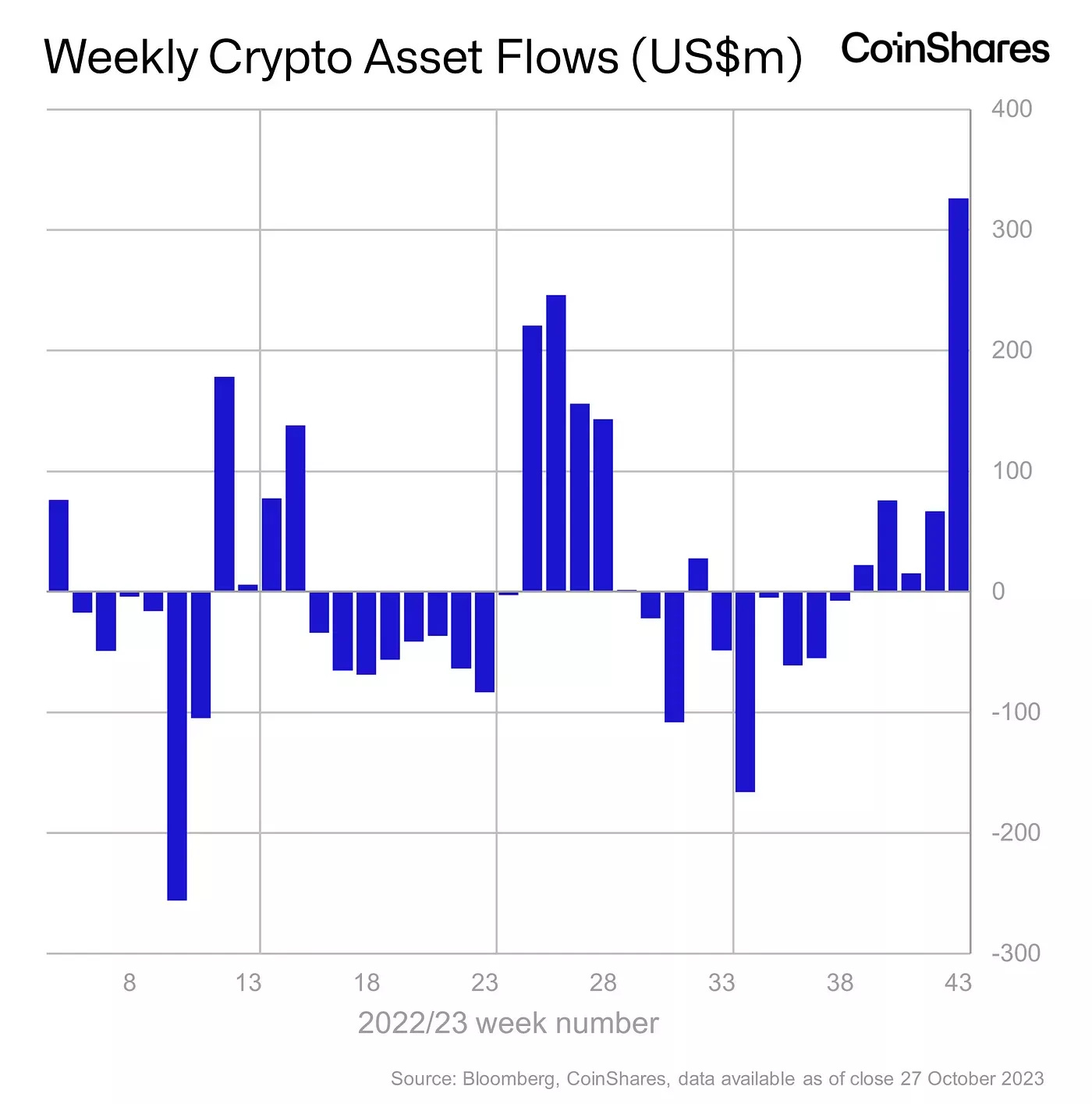

We’ve had the largest weekly crypto inflows since July 2022.

US Treasury intends to borrow $1.6T in net new debt.

This is bullish for "risk-on" assets.

The Institutions are here 🧑💼🏦

If the first three headlines don’t tell us that institutions are getting involved in a big way, we’ve now seen the single largest week of institutional inflows since July 2022.

While the normies (retail investors) were ‘umming’ and ‘ahhing’, smart money (institutional investors) were allocating.

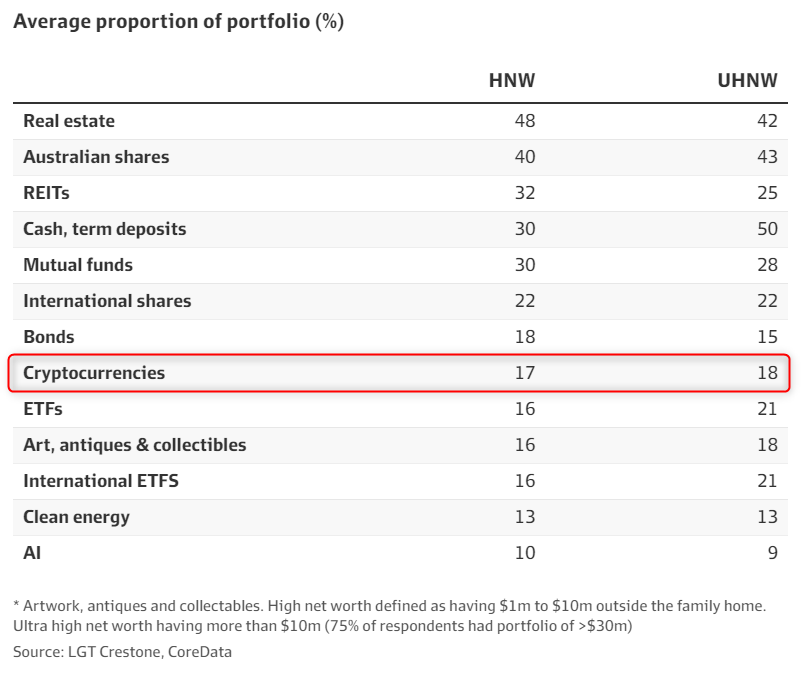

To add weight, a recent AFR article summarised research from LGT Crestone. They showed that ‘High Net Worth’ (HNW) and ‘Ultra-High-Net-Worth’ (UHNW) individuals had ~17 to 18% of their portfolio allocated to crypto.

From my perspective, there are two factors stopping people from investing:

➡️ Uncertainty regarding regulation

➡️ Scared of the volatility.

The way I like to think about it is:

Regulation: If the governments, banks and BlackRock’s of the world are getting involved in blockchain technology, then it makes sense to me that the tech, which is still in its infancy, is here to stay and will continue to grow at an exponential rate.

Volatility: if we zoom out, the annualised performance of blue-chip digital assets like $BTC are 26% at the time of writing. That’s a better return than any fund manager, Popular Investor, or ETF index out there. Well, except PROJECT 10X on eToro of course!

For most people, If they can stomach the volatility, it makes sense to include a small allocation and then forget about it for the next ten years. It’s what’s I like to call the ‘the coma trade!’

But, even after all that, there will always be a “Topravit” who won’t do the research, but has all the answers.

Don’t be a Topravit, or you might end up on the the wrong side of history, like James Chapman, the Science Correspondent for the Daily Mail back in 2000.

The FED gives stocks the green light 🟢🚥

The Fed chair, Jerome Powell has suggested that the Fed was edging ever closer to the end of its rate-hiking campaign after leaving rates on pause for the second time in a row.

Markets have taken his comments as a green light to pile back into ‘risk-on’ equities, with some having absolute monster weeks:

Roku Inc - ROKU +54%

Udemy Inc - UDEMY +41%

Virgin Galactic Holidings Inc - SPCE +35%

Shopify Inc - SHOP +32%

To put it into perspective, these stocks were #downonly for much of 2021 and 2022, and their charts look like a crypto shitcoin. Take Virgin Galactic for example..

IMO, the market is probably correct in its assumption that the FED is done hiking.

Ultimately, it’s not about when the FED decides to cut rates, it’s about the “rate-of-change” of the rate increases/cuts.

If we were to wait until the FED cut rates to invest, we wouldn’t be looking out into the future. We would be acting on present-day information like every other retail investor that loses money.

As a good investor, I believe we need to look 6 to 12 months out. From that perspective, what comes after a hike, and then a pause? I’ll give you a hint. It ryhmes with butt!!

eToro Update 🐂

Not only does PROJECT10X have the highest returns in Australia.

We’ve also had the largest copier growth in the country!

In saying that, it’s a lot easier to go from 14 to 24 than it is 1400 to 2400, but hey - I’ll take the wins where I can get them😝

I also want to give a huge shoutout to my new copiers. Your unwavering support means the world to me! 🙏 I will continue hustling and keeping all 𝟭𝟬𝟬% 𝗼𝗳 𝗺𝘆 𝗰𝗼𝗽𝗶𝗲𝗿𝘀 𝗶𝗻 𝗽𝗿𝗼𝗳𝗶𝘁.

I’ll leave you with the eToro portfolio statistics:

🆙 97% 2Y return

🆙 74% YTD return

💵 12% cash position

⚠️ 5 risk score

and perhaps the performance of PROJECT 10X against the 7 most popular investors on eToro

That’s all for now. Catch you next week.

✌️

Filip Brnadic