Welcome 👋🏽

I recently released a newsletter called The ULTIMATE Guide for Selling the Top.

It’s a set of indicators I used to sell near the top of the last crypto bull run. It helped me turn a 5 figure net worth into 7 figures in one cycle.

If you haven’t read it yet, you can check it out here 👇🏽

Now, I’d love to help you do the same.

I’ve tiered the indicators so you know which ones hold more weight.

Jedi = the ultimate indicators

Normie = great data-driven indicators

Pleb = good gauge of sentiment

I’ve also added traffic lights next to each indicator to identify their status quickly.

🟢 all G baby

🟡 close to hitting this indicator, or we’re seeing early signs (when it comes to sentiment gauge)

🔴 this indicator has been hit!

⚠️ DISCLAIMER ⚠️

The content provided by PROJECT 10X PTY LTD (Filip Brnadic) is for educational purposes only and is not financial or investment advice. PROJECT 10X PTY LTD is not a licensed financial adviser under Australian law.

Investing involves risk, including the potential loss of all funds. Seek independent advice before making any financial decisions.

TLDR

Most of the Pleb tier sentiment indicators are starting to flash 🟡. This is a sign that we are in a bull market (in case you were living under a rock with no internet access). I expect them all to flash 🔴 at the top of the bull market.

The Crypto advertising indicator is already flashing 🔴 and rightly so.

The BTC spot ETFs are now live and Asset Managers are scrambling for market share.

We’re even seeing Larry Fink, the CEO of Blackrock (the biggest Asset Manager in the world) shilling BTC, ETH and the tokenisation of financial assets.

The Normie and Jedi tiers are all G 🟢.

JEDI TIER 🥇

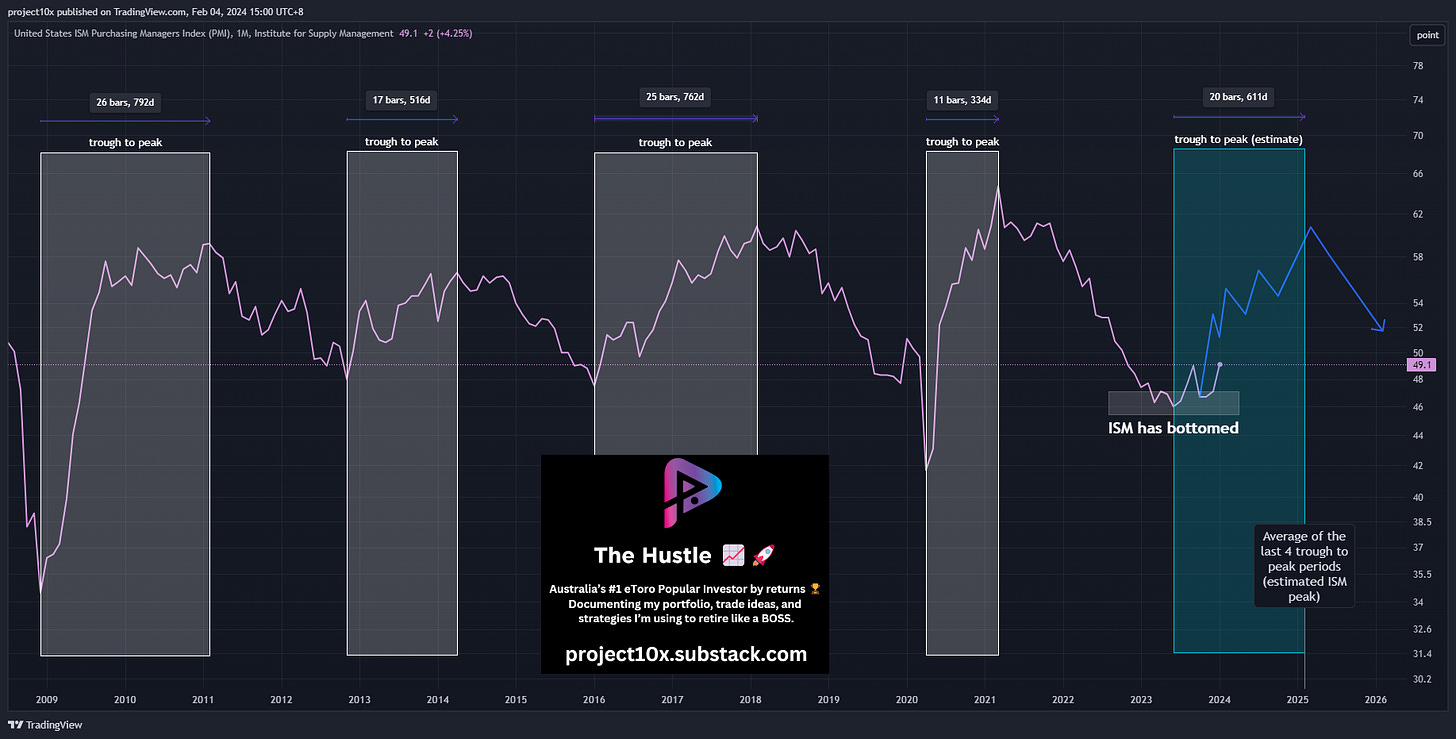

1. Global Liquidity Cycle (GLC) 🟢

Signal: The GLC shows a peak in the markets sometime around Q2 2025 ± 1Q.

Status: The indicator has bottomed and is on an upward trajectory. It seems we’ve got ~1 year to go, so let’s see how this plays out.

2. Semaphore Indicator 🟢

Signal: The bull run ends sometime in H2 2025.

Status: So far this cycle we’ve had a down year, a side-ways year, and are gearing up for 2 up years. We’ve got ~1.5 years until this indicator starts yelling SELL!

3. Pi Cycle Indicator 🟢

Signal: When the white and yellow MA lines cross, this will indicate a PI cycle high. PI Cycle has historically picked bull market tops to within ± 3 days.

This is one of my most trusted indicators. I’ll be doing a deep dive on it next week, so keep an eye out on your inbox!

Status: We’re not even close to hitting PI cycle high - good news!

4. Ultimate Oscillator (UO)🟢

Signal: when the UO on the 2W BTC chart breaks above 75.77, then starts to reverse.

Status: UO = 50.46.

5. Net Unrealised Profit Loss (NUPL) 🟢

Signal: when NUPL reaches ≥ 80% BTC price peaks shortly after.

Status: NUPL = 49%

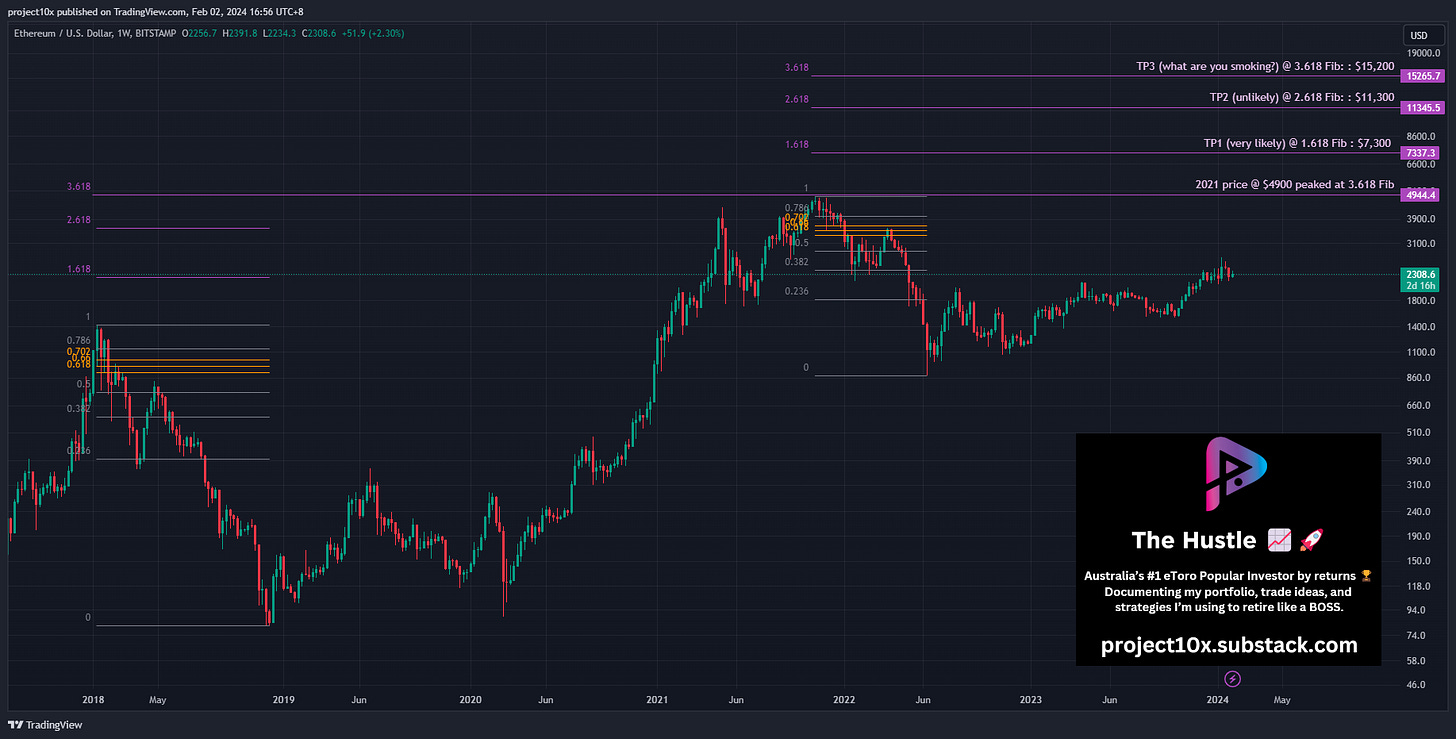

6. Fib Extensions 🟢

Signal: when the price hits the 1.618 Fib of the 2021/22 peak and trough. I’ve provided charts for BTC, ETH, and SOL

Status: BTC, ETH, and SOL have over 100% to climb to reach the 1.618 Fib.

Bitcoin

Ethereum

Solana

7. LTC/BTC Breakout 🟢

Signal: when LTC/BTC is trending down for weeks, followed by a strong breakout. Check out the first newsletter for historic examples.

Status: There has been a downtrend for the last 6 months with no breakout in sight.

8. Log Curves 🟢

Signal: when the price hits the top of the log channel.

Bitcoin Status: Expected to top at ~$106K.

Ethereum Status: Expected to top at $8,200

Solana Status: Expected to top at $260

9. 2Y MA x 5 🟢

Signal: when the price exceeds the red 2Y MA x 5. Historically, BTC price has topped 40, 24, 31, and 6 days after exceeding the red line. That is an average of ~25 days.

Status: BTC is expected to top at $92,218.

NORMIE TIER 🥈

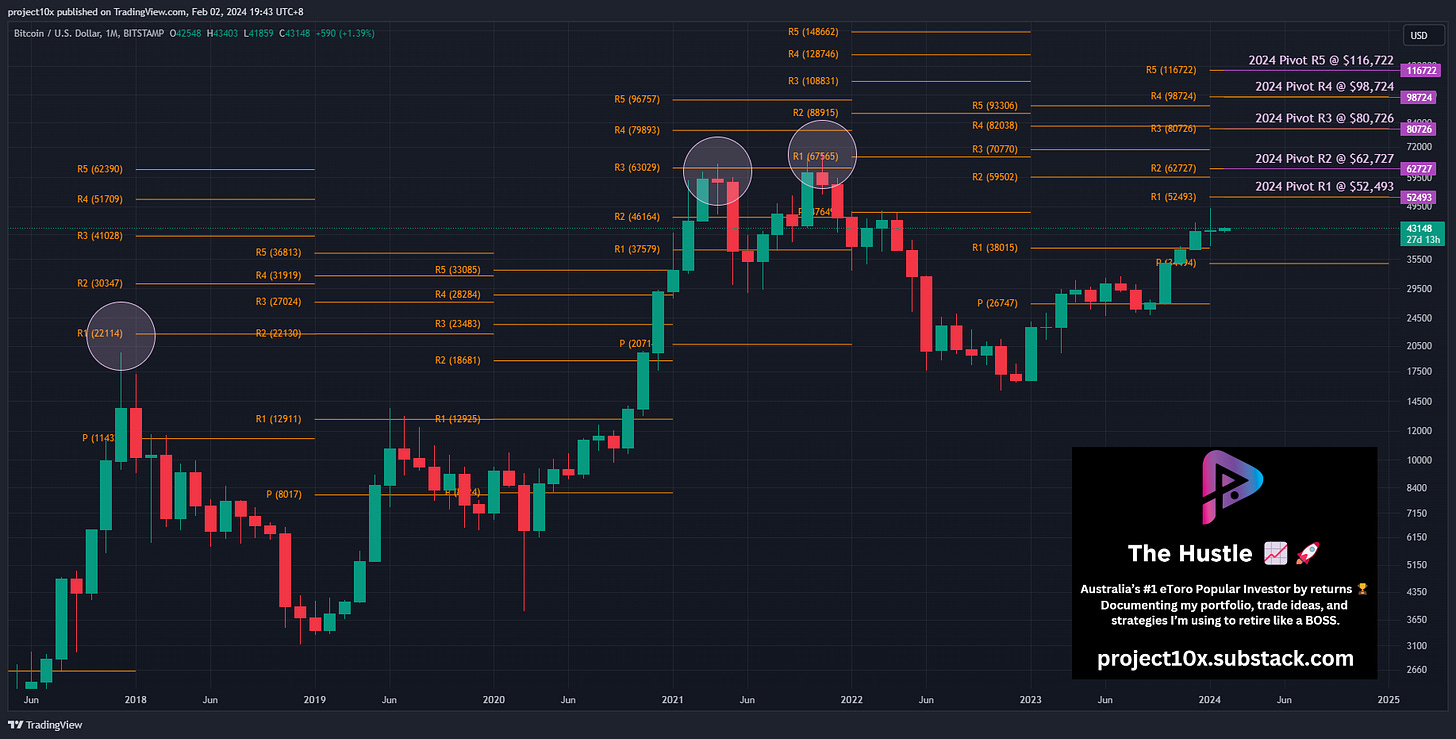

10. Yearly Pivot 🟢

Signal: when price hits one of the key Yearly Pivot points. R4 = $98,724 and R5 = $116,722. I’m expecting a top at these price levels, especially since this price has confluence with many of the other indicators.

Status: Price is ~$43,000 and hasn’t even hit the R1 level for this year.

11. Coinbase #1 App 🟢

Signal: when Coinbase hits #1 spot on Apple’s US App Store Ranking

Status: Currently > #50 in App Store (All Categories) and #43 in App Store (Finance Category)

Hint: Keep an eye out for the native Solana App, Phantom. If that gets near #1 on the App store, there’s a good chance we’ve topped.

12. Total crypto market cap 🟢

Signal: when total crypto Market Capitalisation (MC) hits the 1.618 Fib at $7.2T. I have also labelled a sell zone above $5T. The price at which I think it makes sense to start scaling out.

Status: Current MC is $1.6T

13. Good Traders Selling Spot 🟢

Signal: when the best traders on CT start scaling out of their spot positions.

Status: None of them are calling for a top right now.

14. DXY 🟢

Signal: when DXY slides below ~$91.

Status: $DXY @ $103.96

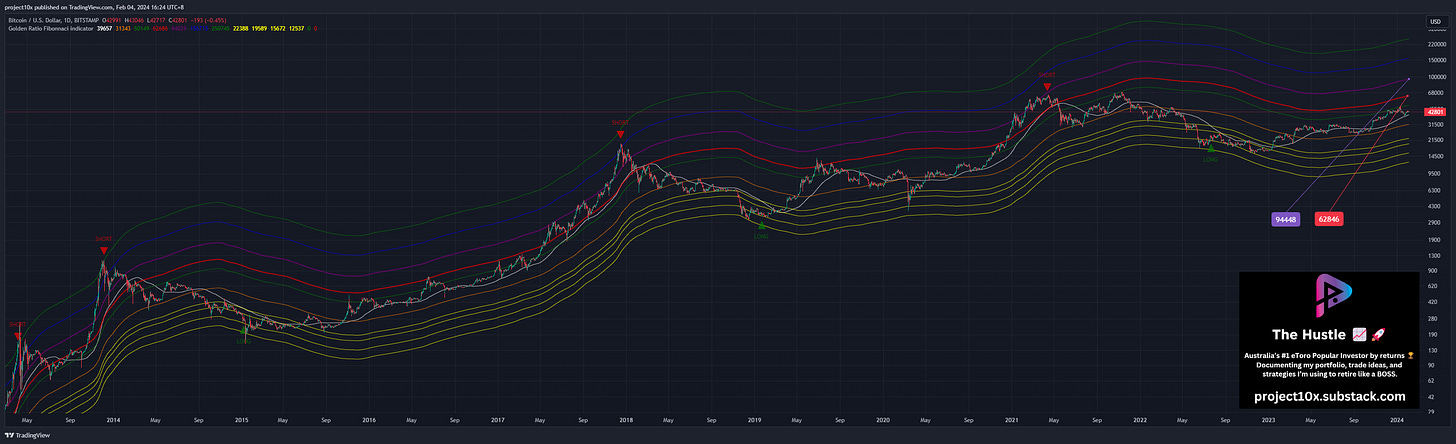

15. Golden Ratio Multiplier 🟢

Signal: when the Golden Ratio Multiplier > 2x multiple and approaches 3x multiple. The 2x and 3x multiples are denoted by the red and purple lines, respectively.

Status: Price is well below the red line (currently @ $62,846) and purple line (currently @ $94,448)

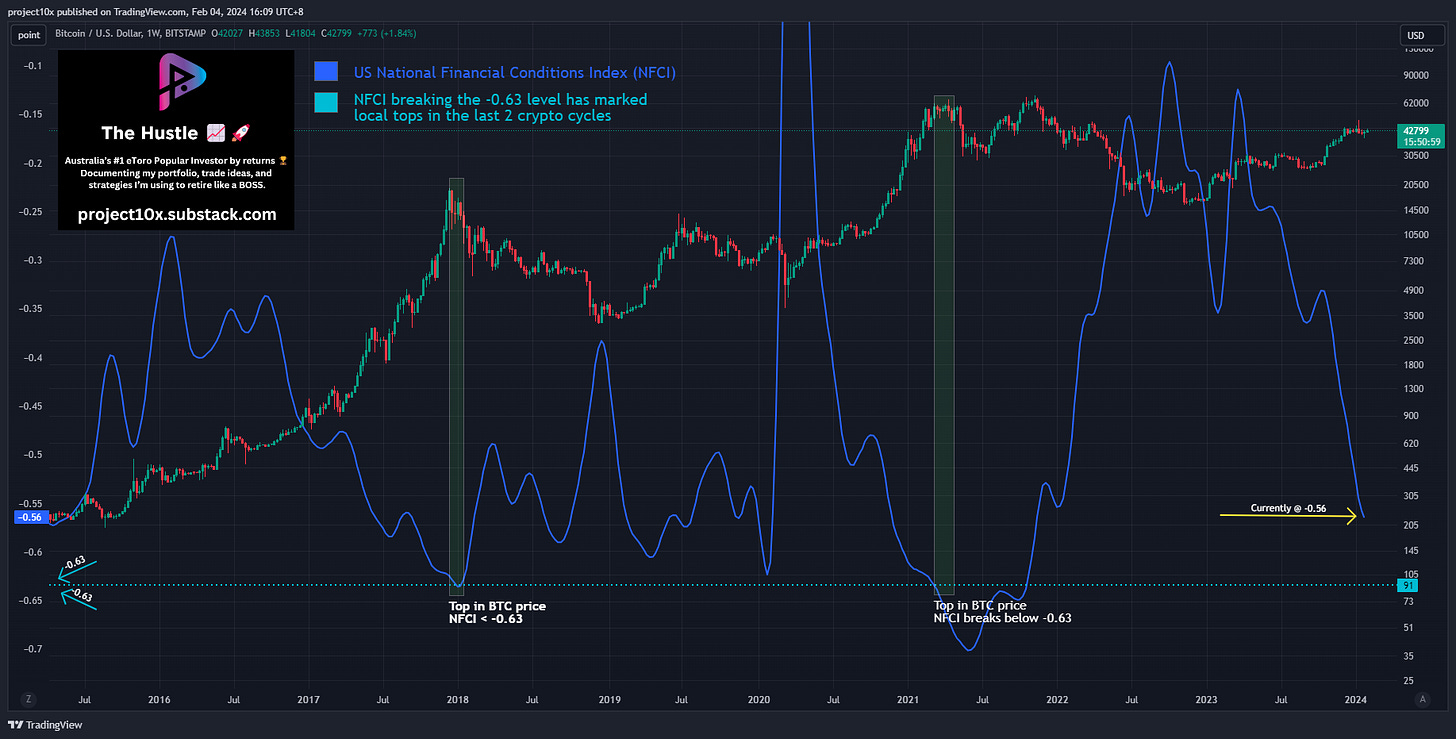

16. National Financial Conditions Index 🟢

Signal: when NFCI breaks the -0.63 level it has marked the local top in the last 2 crypto cycles.

Status: NFCI = -0.56.

PLEB TIER 🥉

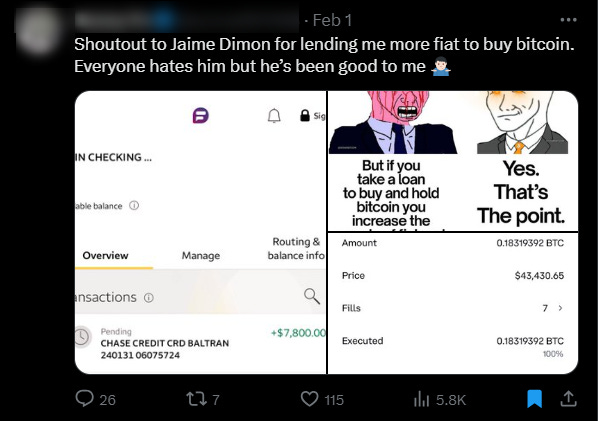

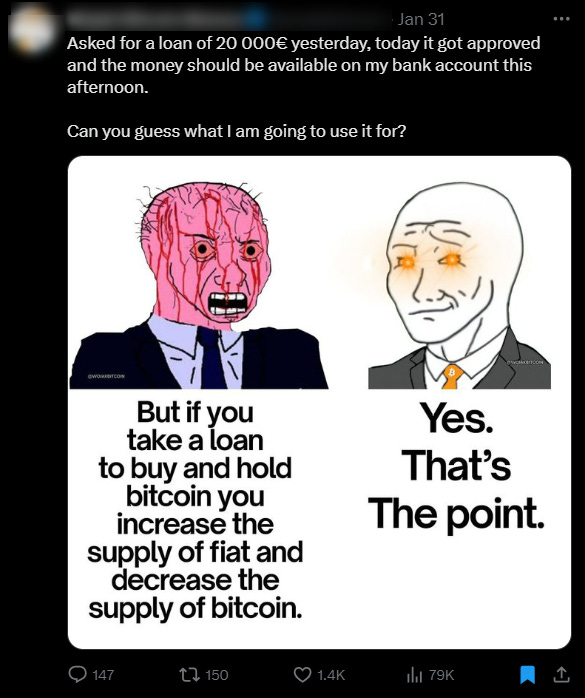

17. Rolex’s, Lambos, and Leverage 🟡

Signal: when you, your friends or CT

start talking Rolex’s and Lambos

borrowing against homes to buy crypto

taking out credit to buy crypto

Status: I’ve started to see more people taking cash out on credit cards and then doing balance transfers to avoid paying the interest rate for 12 months or so.

It’s not necessarily right or wrong. It’s just a gauge of the market sentiment. I did the same thing in the last bull run just before BTC broke it’s ATH in December 2020. It worked out pretty well for me because I sold BTC at ~$52K.

18. Normies Entering 🟢

Signal: When your normie friends and family start asking about crypto or asking you to “buy some for them”.

Status: This is, of course, relative. So far, none of my normie friends have been asking about crypto.

19. Crypto Conversations 🟢

Signal: When crypto pops up in conversation every time you go out.

Status: This is also relative (hence why it’s a pleb signal).

20. Real Estate Shopping 🟡

Signal: when you, your friends or people on Crypto Twitter (CT) real estate shopping

Status: I admit that I recently checked out a dream apartment. I’m at least a decade away from dropping that sort of money on property, but a man can dream!

21. Celebrity Promotions 🟡

Signal: when celebrities like Katy Perry start posting about crypto

Here is a post by “Soulja Boy” just last week. It’s starting…

22. BTFD and HFSP 🟢

Signal: When you start hearing BTFD and HFSP on CT and eToro.

Status: I haven’t heard this type of bull market euphoria just yet, and rightly so, we haven’t even cleared ATH.

23. Legal Tender 🟡

Signal: when more countries start accepting crypto as legal tender

Status: It’s official. The new Argentinian President has legalised crypto as legal tender

24. Crypto Advertising 🔴

Signal: When crypto ads start popping up everywhere. I’m talking stadium naming rights, Las Vegas sphere ads, and TV commercials.

The BTC spot ETFs are here and the commercials have been nothing short of amazing.

Google has even updated its policies to allow BlackRock, Grayscale, and Fidelity to showcase their offerings via ads on the search page.

Alta Blockchain Lab brought in the 2024 New Year with a rocket Christmas tree in NY Times Square.

25. IPOs 🟡

Signal: when you hear news of big players like Circle and Kraken looking to IPO

Status: It’s only February 2024. We haven’t even had the BTC halving and our first IPO bingo card has been checked off. Thank you, Circle (the Company behind the stablecoin USDC).

That's it!

I hope you find this as useful as I did in the last bull run.

If there are any other indicators you think I should check out, let me know in the comments below.

Catch you next week.

✌️

Filip Brnadic

Pretty solid indicators, good stuff.

Nice!