Trading the Liquidation Cascade

The playbook I built after the biggest wipeout in crypto's history.

Welcome 👋🏽

There are times when markets lose their mind, and the best thing you can do is surround yourself with sharp, like-minded people. Some folks choose to doomscroll X. Others stare at charts for hours.

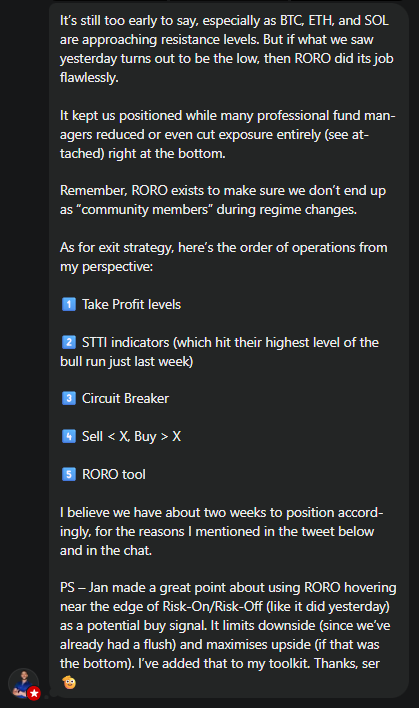

Our community chat, on the other hand, came alive like never before - traders sharing strategies, calling out potential entries if this really was the bottom, and helping each other map out their next move. Here’s a snapshot from one of the many discussions we had on Friday, 17 October 2025 👇🏽

We agreed that if our Risk-On Risk-Off (RORO) tool flipped to Risk-Off 🔴, we’d cut exposure. No hesitation. Only re-enter once RORO confirmed Risk-On 🟢 again.

Luckily for us, RORO did not flip to Risk-Off and as markets rally today, the RORO did it’s job! I shared this the following day 👇🏽

I’ve said it 100 times, and I’ll keep saying it. If you’re not active in the community chat, you’re missing out on what truly makes this group special. I might be the one writing the newsletter, but the collective brainpower here is unreal. We’ve got nine-figure whales, Tech bros, TradFi bros, Gold and Silver bugs, early retirees from crypto, ADA whales, BTC HODL’ers, and DeFi degens who could run circles around me - all dropping their insights.

Don’t miss out on the live discussions and updates just because you’re not plugged in.

Download the Substack app on Android or iOS, jump into the chat, and say hello 👋🏽

Now that we’ve got that out of the way, and before diving into strategy, I want to share a quick journal entry about my capital allocation over the past week.

Specifically, how I positioned following the liquidation cascade - and a few key lessons I’ve since integrated into my investment methodology.

Let’s start with a few questions…

Why did I enter when I did, right after the liquidation cascade on 10 October 2025?

Having been almost entirely in cash since mid-September, earning an eye-watering amount through DeFi and short-dated treasuries, I was already in a strong position. But I’ve been talking for months about the reflexivity of the “bull market ends in Q4” narrative, and how that belief could impact price and accelerate a reversal as traders front-run it.

Before “Uptober” began, I published a newsletter saying we’d go lower before going higher, at a time when that view was anything but consensus 👇🏽

A week later, I released another one - confident that we’d likely “get another bite of the apple,” due to my extremely bullish macro outlook 6 months out 👇🏽

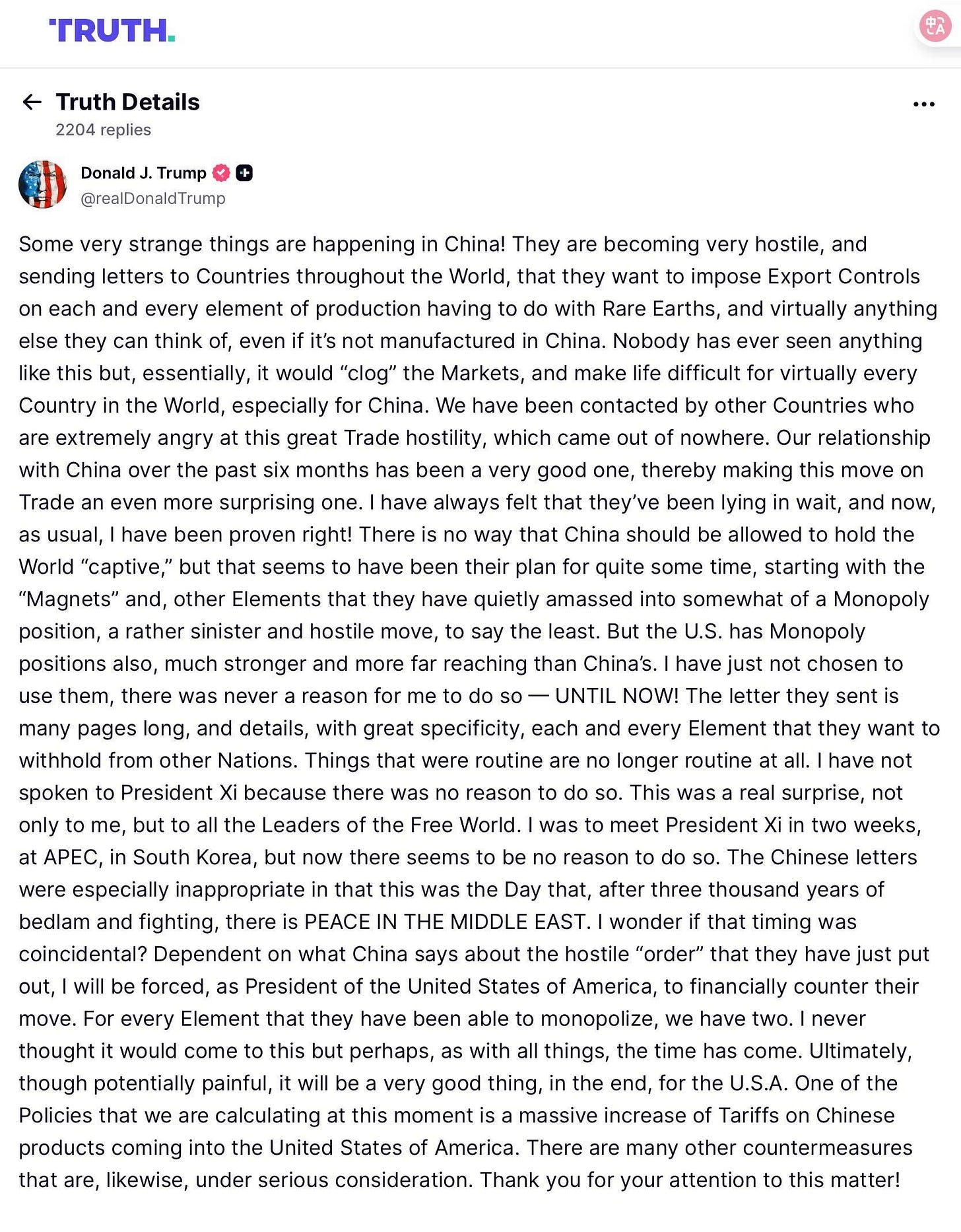

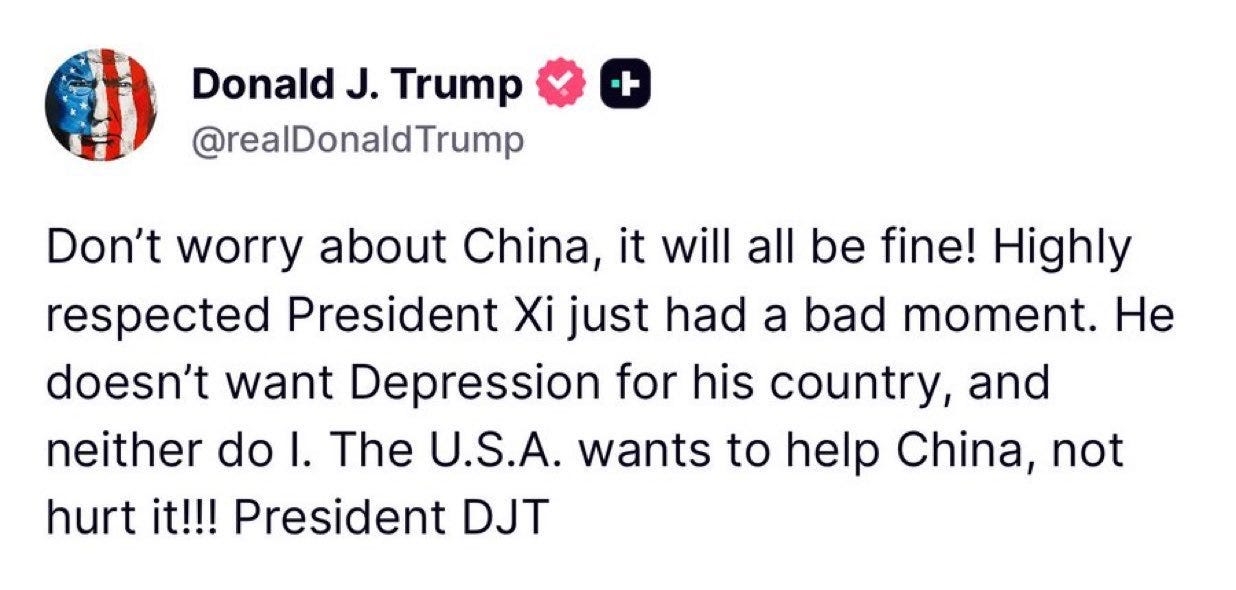

Then came the catalyst: Trump’s original tweet 👇🏽

Followed by a second tweet 👇🏽

And finally, on Monday 13 October, just before equity futures opened, Trump dropped TACO’d (Trump Always Chickens Out), to calm markets 👇🏽

At that moment, I was convinced the “trade war” would eventually be over, and I did not want to be sidelined. In last week’s newsletter, I said (and still believe) that this will resolve itself in the coming weeks 👇🏽

So when that tweet hit, I didn’t want to be sitting on the sidelines watching the next leg unfold - this ladies and gentleman is classic FOMO.

I initially allocated 30%, and over the coming days, I allocated up to a total of 75% of my capital.

Whether we push to new all-time highs from here, which remains my base case and what I’ve been saying for months (that the bull run continues into 2026), isn’t the point.

The reality is

I did feel FOMO

I was confident my play was correct

I didn’t want the market to run away without me

But I was forgetting one key variable. Trump’s tweet wasn’t a resolution - it was a de-escalation, and frankly, I did not need to rush to allocate, because I was leaving at least some money on the table.

How did I feel emotionally at that point, and how do I feel now?

When the liquidation cascade hit and I was sitting mostly in cash, I felt an enormous sense of satisfaction. My strategy had played out exactly as intended. While the moon boys were screaming “Uptober,” I was on the sidelines, because my take-profits (and circuit breakers) had already triggered.

Capital was preserved, and I was ready to go shopping.

That said, I’d be lying if I said I wasn’t feeling a little FOMO in early October. I had that lingering thought of “what if Uptober actually happens and I miss it?” But I anchored myself with a mental model that’s served me well:

What would I do if I were managing a $1B portfolio after the run I’ve just had?

That framing made it easier to sit down, shut up and keep that sweet sweet DeFi yield coming in. I knew I was still earning ~4% in treasuries and ~10% in DeFi, and deep down, I knew that when something becomes consensus (like “Uptober”), it rarely plays out as expected. Why? Put yourself in the position of someone that needs to offload $2B in ETH for example. Those folks need exit liquidity, and when better to have exit liquidity when normies are on the other side of your trade, while markets are basically at all time highs?

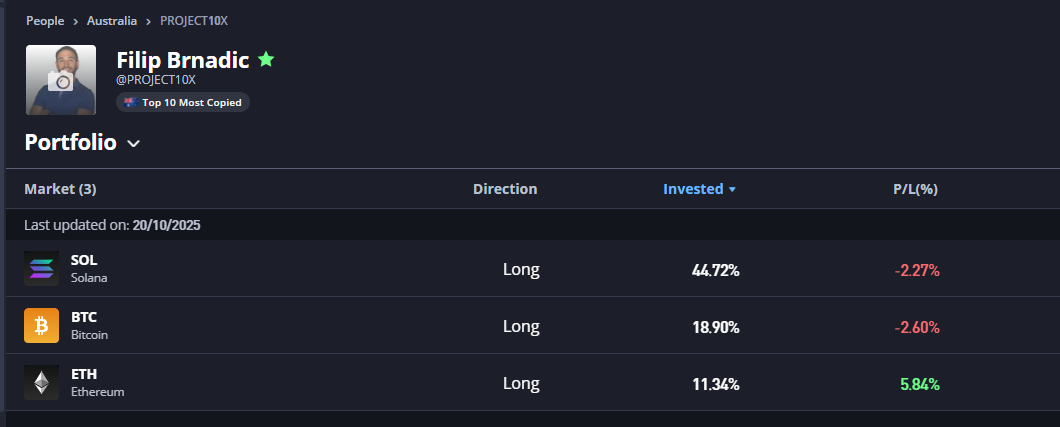

Now, fast forward to today. After deploying ~75% of the portfolio while the X and eToro feeds are as bearish as I’ve ever seen them, I’ll be honest, it doesn’t feel great.

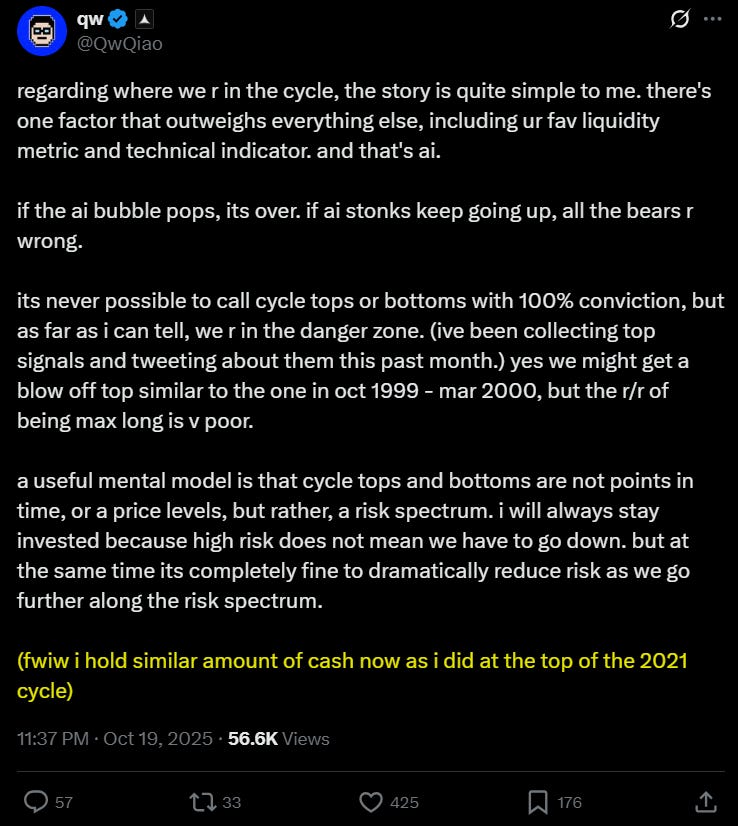

You read this from people you respect:

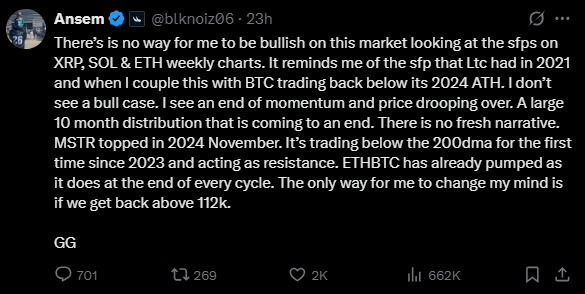

and this:

and this:

and there is no doubt that you second-guess yourself.

Do I actually have more of an edge than these guys?

They’ve been in the space longer than me - what if there’s something I’m missing?

What are they seeing that I’m not?

These are tough markets and the inflection point we’re in has inevitably caused my sleep to deteriorate from the optimal levels it usually is! - not to mention, I’ve come down with the flu whichwas probably passed on from my daughter being sick the week before, but no doubt being in this “pressure cooker” environment played a role in weakening my immune system.

What added to it was that my normal routine for managing stress (gym, sauna, red-light therapy, ice bath) has been on hold since I’ve been sick.

All that aside, there is one thing I’ve learnt above all else:

If it feels good to allocate, you’re probably doing it wrong. Selling when everyone’s euphoric and buying when everyone’s terrified never feels good but that’s where we find the most asymmetric risk-reward.

This is a difficult market. Ansem (popular trader on X), for instance, flipped bearish near the top a few weeks ago, then flipped bullish literally days before the local top, and just last flipped bearish again - right before markets rallied this morning.

This tells you everything you need to know about markets and market psychology. Markets can break your conviction, twist your psychology, and turn you into a brokie real quick.

Anyway, let’s move on 👇🏽

Could I have taken a better approach?

This is where strategy refinement comes into play.

Right now, I’m down ~-1.5% from my entries, and the portfolio is down ~-8% from its all-time highs. Let me tell you, the picture looks a little better than it did on Friday.

But, putting this into context:

➡️ BTC is down ~-13% from its ATHs

➡️ Perp traders got completely wiped out during the liquidation cascade

➡️ I sold almost everything right near the top before the drawdown

➡️ Most eToro Popular Investors trading crypto are flat or negative YTD

Given all that, I’d rate my allocation strategy post-cascade as fair, not great because I could have gotten even better entries.

If I could go back, what would I do differently?

First, I would have staggered my capital deployment. I didn’t have to allocate 30% and then 60% so quickly.

Why? Because, frankly, I’ve already made it. I’ve had a monster run, crushed every performance metric, and didn’t need to swing for the fences right after one of the biggest liquidation cascades in history.

I got greedy - not recklessly, but still greedy. Even though the total portfolio drawdown was capped at -10%, the entry could’ve been better. Some will call that nitpicking, and that’s fine. But in this game, the small refinements compound.

Second, considering this was a liquidation cascade, I could’ve analysed previous ones to identify typical post-event behaviour. Just because I’m bullish on the six-month macro picture doesn’t mean there’s no room to study short-term patterns. History doesn’t repeat, but it does rhyme - and ignoring that rhythm costs precision.

Which brings me to the next question 👇🏽

What learnings can I extract to improve in the future?

I’ve got two.

Lesson 1: How to trade liquidation cascades

Context. On 10 October 2025, BTC wicked to ~107K on Binance, then traded as low as ~103K, an ~18% drawdown from the ATH.

In past cascades, price often returned to fill the wick:

18 Apr 2021, wick filled, then the trend moved lower.

19 May 2021, wick filled, multiple Swing Failure Patterns (SFPs) failed to push price lower, then trended higher.

22 Feb 2021, wick filled, then trended higher.

7 Sep 2021, wick filled, then trended higher.

There are edge cases during these events. As we have learnt, some sh**coins can go to literal zero during oracle dislocations.

Exhibit A: ATOM, which invalidates a simple wick-fill assumption. We’ll probably never see that price for ATOM again, given that even “dead dino coins” still have some market cap.

SOL handled it much better than the lower cap sh**ters. It fell from ~$240 to ~$145 due to the oracle dislocation. We can reasonably expect that during these scenarios, the wick may not fill. On that basis, if we get these liquidation anomalies, we can allocate in the lower third or retest of the low of the next “normal” candle for those cases, not the cascade wick itself.

However, in a typical liquidation cascade for SOL, such as the one seen on 7 September 2021, we can fully expect the wick to fill.

So, after all that, what is the strategic learning and how do we apply it to future cascades? 👇🏽