How Much Do You Really Need to Retire?

The math, the myth, the legend.

It doesn’t matter whether you’re 20, 30 or 60. If you’re not thinking about what life will be like when you’re old, frail and piss your pants on the reg, then you’re asking for trouble.. at your weakest.

A more elegant way to put it, perhaps is that

a person often meets his destiny on the road he took to avoid it

- Jean De La Fontaine

Think about it. Do you want to barely be scraping by at 70, or do you want to be doing whatever the f*** you want, when you want, on your own terms? I mean, look at Gladys over here. #retirementgoals.

And for the love of sweet baby Jesus, if you’re one of those people who believe the government pension is enough, then you do you.

You and I just have drastically different views of what we want our retirement to look like.

I want to

Travel the world for months on end every year, having already travelled to outer space at least once.

Have meals prepared, apartment cleaned, and nappy changed for me (if required).

Live in a beautiful apartment right in the middle of Perth CBD with views overlooking the Swan River, South Perth foreshore, and the rest of the city.

Have the highest level of health insurance cover and the ability to purchase stem cell treatments, cell and gene therapies, lab-grown organs or whatever the latest breakthroughs in medicine are.

Create generational wealth for my kids and their kids, and so on.

Seems unrealistic? I would expect it to. It’s my retirement goal. Everyone is different. I can assure you it’s very plausible. Keep reading..

There are three things to consider when it comes to working out your retirement goals.

How much do you need to retire?

How much can you put toward retirement?

When do you want to retire?

Let’s work through each of them.

⚠️ DISCLAIMER ⚠️

The content provided by PROJECT 10X PTY LTD (Filip Brnadic) is for educational purposes only and is not financial or investment advice. PROJECT 10X PTY LTD is not a licensed financial adviser under Australian law.

Investing involves risk, including the potential loss of all funds. Seek independent advice before making any financial decisions.

How much do you need to retire? 🤔

My wife and I have a retirement number in mind….but more on that later.

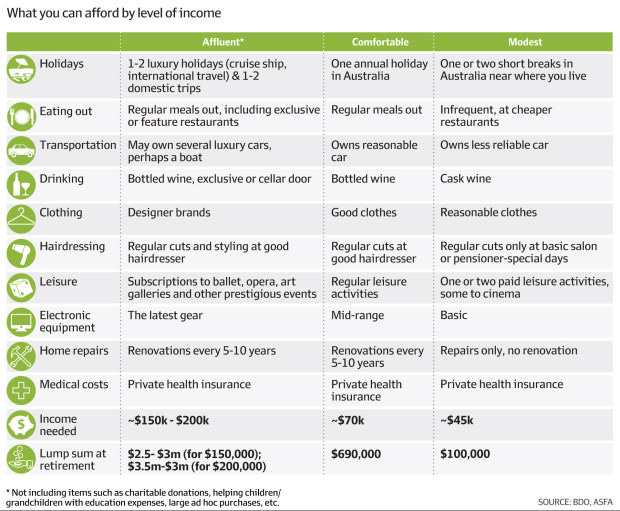

BDO consultants have calculated how much we, Aussies need to retire and live life the way we want, assuming we:

own our own home

are relatively healthy

have a significant other

It’s all summarised in one simple graphic. Study it. Don’t dismiss it. They are wealth advisors. It’s their job to know this stuff. Don’t be a numpty.

For Europeans, South Americans and parts of Asia where the cost of living is cheaper, this number will probably be a lot less.

So what do the numbers tell us?

Modest retirement living (that’s one way to put it) :

Who in their right mind wants to live on “cask wine” and hair cuts on pensioner special days?

I’m not even getting into this one. If you’re comfortable with this lifestyle, then this probably isn’t the newsletter for you 🤦🏽♂️.

Comfortable living:

This is the lifestyle that most Aussies will afford.

Keep in mind, you’re not holidaying outside of Australia, but at least the wine is bottled!

You would need $690K is equities/cash/superannuation (investments) and $70K annually.

That means you would need a ~10% yield on your investments each year. I would err on the side of caution and double that $690K investment lump sum, so that your investments only need to yield 5%. THEN I would say you would be able to live in the “comfortable” category..comfortably.

Affluent living:

That’s more like it!

We would need between $2.5M and $3.5M in investments to live really well.

We could spend $200,000 a year on the electronics, holidays, events, cars etc. we want without having to worry!

Same as above. To be safe, I say double it. $5M to $7M.

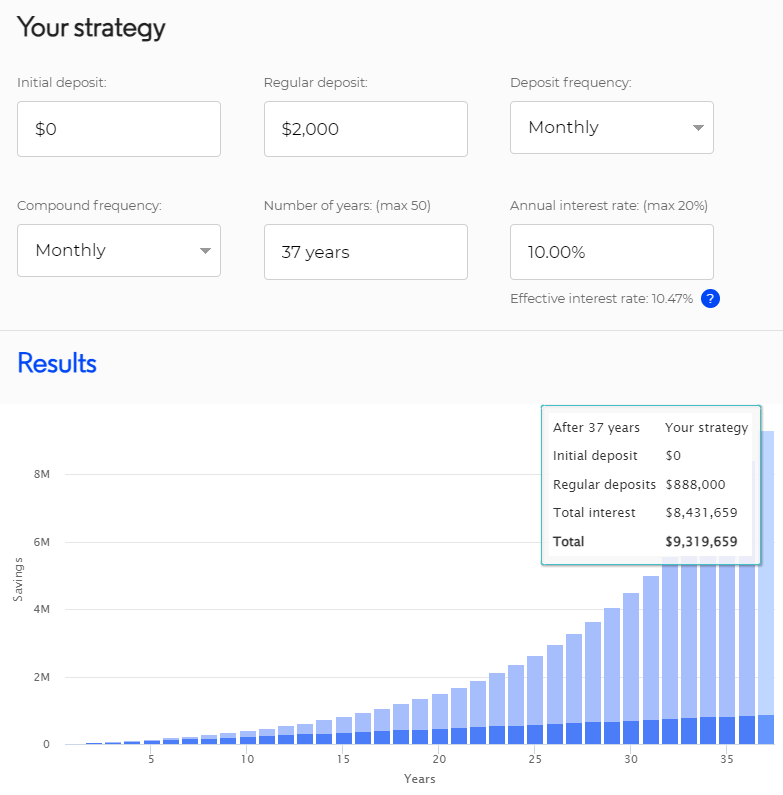

I’m going to use Mary and Bob - a 30-year-old couple as an example.

To get to $7M they would need to invest $2000/mo until Australia’s retirement age (67) into a strategy yielding 10% per annum.

In fact, they would end up with ~$9.3M according to our calculator.

A portfolio consisting of 100% VOO 0.00%↑ will give them more than 10% return, but that is not the problem.

The problem is lifestyle creep. As we earn more, we spend more.

Most people in their thirties are already paying off a mortgage, sending 2 kids to a private school, going on 2 to 3 holidays a year, eating out 3 times a week, and buying a new car every 5 years.

So what’s the solution? Ramit Sethi says it best.

“Spend lavishly on the things you love and cut mercilessly on the things that don’t matter to you”.

How much can you put toward retirement? 🫰🏽

I recommend every person who doesn’t already have a budget or conscious spending plan to download Ramit Sethi’s Conscious Spending Plan and fill it out.

You need to know your numbers.

If, after looking at their numbers, Mary and Bob are still unable to allocate $2000/mo to investments, they have three options:

Keep cutting expenses; or

Extend their time horizon from 37 years to 40 years?; or

Make more money so they can invest more.

Nobody said it was going to be easy.

You know, my wife and I don’t have a mortgage or a fancy car, and we don’t eat out at fancy restaurants. Those are not our money dials. We like to travel.

We also invest EVERY. SINGLE. MONTH. We invest like we’re paying off property worth seven figures to fund the lifestyle we want at retirement. We’re religious about it. No excuses.

Back to our retirement number.

It’s $10M.

It probably seems ridiculous to some. That’s ok! It’s not my number that is important, but it lines up perfectly with the BDO projections. Let me show you….

We are proud renters. We want to buy a “forever home” when we don’t need our money working for us as much.

We plan to buy a $3M (3 bed, 2 bath) apartment in the middle of Perth. It’s a shitty investment, but it gives us the lifestyle we want i.e. amazing city-wide views, great location, pool, 2 cinemas, BBQ areas, cabanas on the top floor, a fully equipped gym etc., all without having to maintain it (included in the strata fees)

For perspective, we went and had a look at the apartment below recently. This is going for $1.6M with $9000 per annum in strata. An apartment like this will probably be going for $3M+ when we retire.

That leaves us with $10M - $3M = $7M. Exactly double what the BDO consultants suggested!

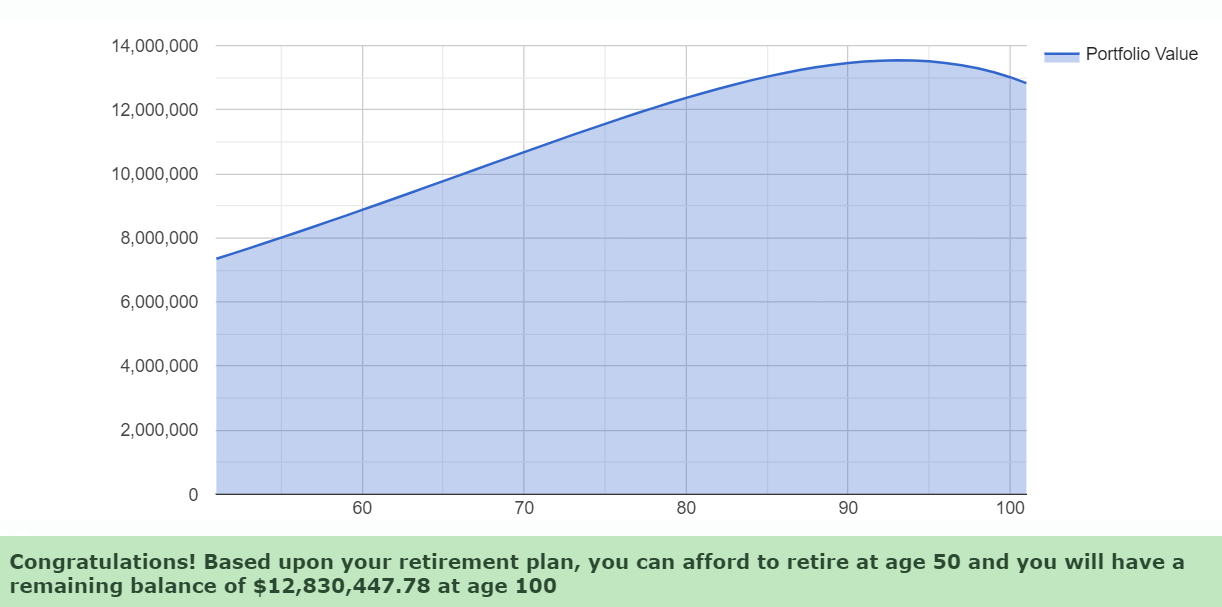

Now, have you ever heard of the 4% rule? If you pay a financial advisor ~$4000, they’ll tell you all about it!

Basically, it’s a retirement planning guideline that:

Helps determine how much a retiree can safely withdraw from their retirement savings each year.

The rule suggests that a retiree can withdraw 4% of their retirement savings in the first year of retirement, adjusting the amount for inflation in subsequent years, without the risk of running out of money over a 30-year retirement period.

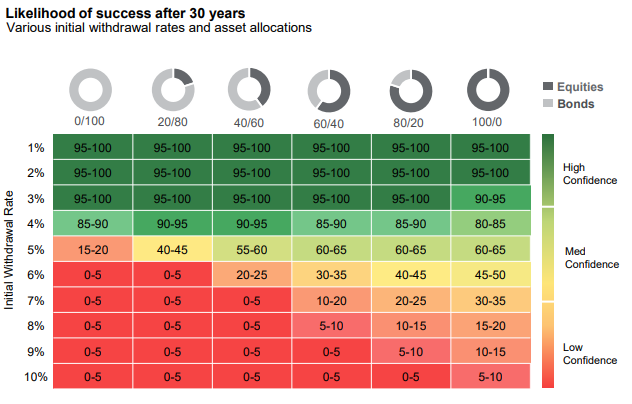

As you can see, for a portfolio made up of 100% equities (far right, similar to what mine will probably be at retirement), we can withdraw 4% and have a medium level of confidence (80 to 85%) that we won’t run out of money in 30 years.

Or in other words a 15% to 20% chance that we will!

Well, 4% of $7M = $280,000. Remember, BDO has already established that $200,000 will provide for an affluent lifestyle.

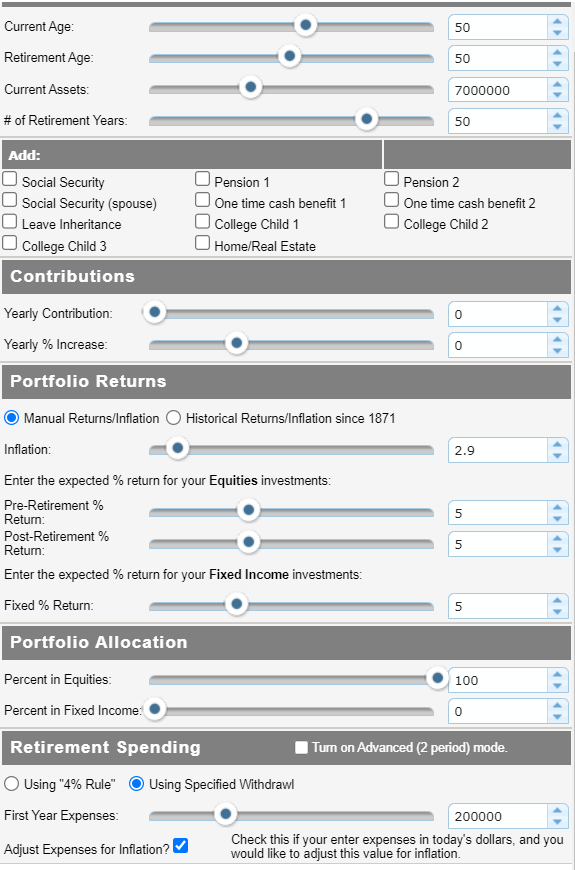

So, plugging those numbers into a retirement planning calculator we get:

Now, assuming we can still grow the portfolio by 5% each year:

A $7M portfolio at 50 years old, would be worth $12.8M by the time we are 100 years old

While still spending $200K a year, and accounting for inflation.

It’s amazing how compound interest works, huh?

5% growth isn’t an issue if that’s what you’re thinking. Even if we dumped it all into the S&P 500, I would see 10.5% per annum annualised, so I’m being conservative.

Leaving our kids with that amount of money is fantastic. If they fu** that up, then you’re on your own little buddies!

When do you want to retire? 🎊

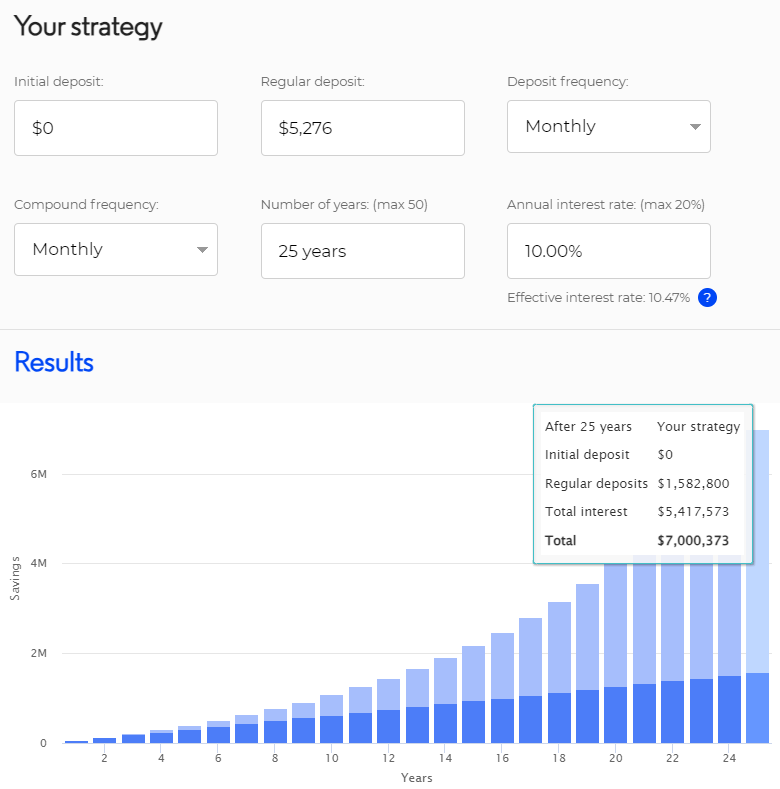

This is the easy part. If you already know how much you need to retire, then you can work backwards. Let’s use 30 year old Mary and Bob as an example again.

We’ve already established that at the ripe age of 67 years old they would have $9.3M by investing $2000/mo for 37 years with a 10% annualised return.

What if they wanted to retire at 55 with $7M?

Well, to calculate that we

change “number of years” to 55 - 30 = 25

play with the regular deposit until we hit $7M!

And what do you know! Mary and Bob could reach their goal if they contribute $5276/mo!

Notice how I did not change the 10% yield? That’s because the VOO 0.00%↑ has a 10 year annualised yield. Most people can’t beat the market over the long-term, so it’s best to stick with that yield. If you want to speed up retirement, invest more!

That’s all for today. I hope that’s given you some ideas on how to “run the numbers” for your own situation.

If you want to get serious about the things I’ve discussed:

Read “How to Get Rich” by Ramit Sethi. It’s the best personal finance book on the market.

Check out this AFR article on what a $3M retirement looks like

Watch this cracker of a video on creating and preserving generational wealth

✌️

Filip Brnadic

Filip - 38%

next in line Greenbull - 18%

Bravo

you are amazing guys...keep up the good work