What’s Next for my Portfolio in 2025? My Bull and Bear Scenarios

Issue #13 - Tailwinds, Headwinds, and My Game Plan🚀

Welcome👋🏽

⚠️ DISCLAIMER ⚠️

The content provided by PROJECT 10X PTY LTD (Filip Brnadic) is for educational purposes only and is not financial or investment advice. PROJECT 10X PTY LTD is not a licensed financial adviser under Australian law.

Investing involves risk, including the potential loss of all funds. Seek independent advice before making any financial decisions.

What is this newsletter series about? 🤔

This newsletter series tracks me turning a single $3800 investment into $1M in 30 years through my public investment portfolio.

This newsletter series also serves as

my macro view

a highlight of my portfolio changes

and a check-in on how we’re tracking towards the $1M goal.

But this week, my newsletter is laying out my game plan going into 2025.

Portfolio Strategy

Let’s start with my portfolio strategy, then zoom into the narratives, and finally, the outlook.

At its core, my strategy is simple yet ambitious: grow the wealth of my family, friends, copiers, and community on eToro.

Here’s how I execute:

✅ Aligned Trades: I take the same trades on eToro as I do for my private clients and various entities, ensuring alignment while staying within eToro’s risk parameters.

✅ Targeted Growth: Aim for a 30% annualised return, particularly during the early stages of bull markets.

✅ Structured Take Profits: My 20/20/60 rule ensures that no matter how the final year of a bull market plays out, my copiers and I always walk away profitable.

✅ Risk Mitigation: Zero exposure to risk-on assets (crypto and tech) in risk-off environments.

Above all, I focus on outperforming BTC across cycles, whether you measure it from top-to-top or bottom-to-bottom. The goal isn’t reckless gains but sustainable growth, avoiding risks like being overly exposed during the final year of a bull run.

Since January 2021, this approach has delivered a ~49% annualised return on eToro.

Now, there may be some degens thinking

“That’s bugger all, I could make that on one trade”.

You’re right. You could.

So could I, if I was trying to run up a $3000 portfolio.

But I ain’t.

The reason why my goal is 30% annualised is because it is a reasonable return in crypto (nothing too extreme) and will ultimately make my community (family, friends, copiers) very wealthy over 15 years.

Let me show you.

Starting with $100K, adding $1K monthly (increasing deposits by 3% annually), and maintaining 30% returns over 15 years grows to $12.1M. The caveat? Discipline. Success hinges on my copiers resisting short-term temptation and committing for the long haul.

I’ll be the first to admit, this is no small feat. Irrepsective of whether it’s crypto or tech stocks, to achieve this sorts of returns will require nagivating cycles carefully. Much of the growth will unfold in the next two cycles (~8 years), due to the law of diminishing returns 👇🏽

As for 2025, while bullish, I won’t jeopardise the portfolio’s long-term goals for marginal gains. The reasoning is simple:

Bear Market Bottoms (Nov 2022): Maximum upside, minimal downside.

Current Market (2025): Minimal upside, maximum downside.

Whether the market peaks in the broad consensus views of Q1 or Q4, it doesn’t matter to me. These are simple estimates based on last cycle which showed much of the price appreciation during this period 👇🏽

My focus since Q3 2024 has and will continue to remain the same.

Nailing the exit strategy, guided by my ‘Risk-On Risk-Off’ (RORO) tool and ‘Selling the Top’ (STT) indicators.

Besides, what’s more important than time is the narrative or ‘price appreciation fuel’ for 2025. Remember, as this cycle goes on, bullish narratives will come and go and as the narratives have run out, what’s left?

The price to go down!

With that said, let’s get into the narratives for 2025.

2025 Narratives

Here I’ve broken down the key narratives shaping 2025 into two likely scenarios. In fact, there is a third scenario - a bearish one, but I don’t want to focus on that given it’s the least probable and the more I write, the more likely my readers are to 👇🏽

Base Case: $130,000-150,000 per BTC

In this scenario, steady progress defines the year:

Strategic Bitcoin Reserve (SBR): The US holds its current BTC reserves (~198K) without further accumulation, establishing them as the nation’s SBR.

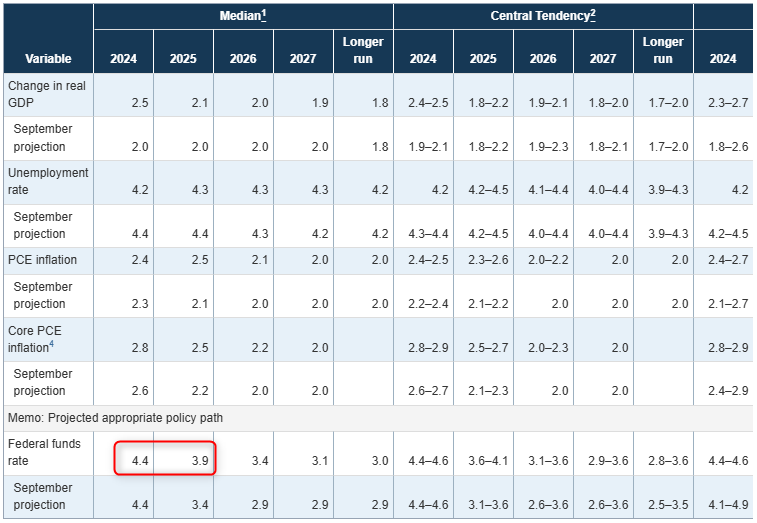

FED Policy: Two projected 25 bps rate cuts, aligning with the December 2024 FOMC projections.

Institutional Adoption: Corporate BTC purchases and ETF flows maintain their current pace.

Strategy:

Take Profits (TP) in line with the 20/20/60 rule and STT indicators.

Avoid reallocating idle capital until the bear market strategy is implemented (details to follow).

Expected 2025 eToro Returns:

~35-50%.

Bull Case: $200,000+ per BTC

A more aggressive adoption cycle drives this outcome:

SBR Expansion: The US adopts an official SBR policy, aligned with the BITCOIN Act, purchasing 200K BTC annually for five years to build a 1M BTC reserve.

Accelerated FED Easing: Faster-than-expected rate cuts as core PCE inflation cools.

Adoption Surge: Corporate BTC adoption accelerates, supported by ETF flows, and a significant entity, be it a “MAG 7”, a US state, or a nation-state adding BTC to their balance sheet.

Market Structure Bill: The Digital Asset Market Structure (DAMS) Act passes, establishing a clear regulatory framework that closes gaps, protects consumers, and provides much-needed clarity for institutional adoption.

Stablecoin Bill: A regulatory framework for payment stablecoins is enacted, ensuring they are fully backed 1:1 by U.S. dollars or other high-quality liquid assets like Treasury bills. This increases trust, unlocks institutional capital, and further integrates stablecoins into the global financial system as a seamless bridge to Bitcoin and other digital assets.

Strategy:

Follow the base case approach.

Consider a short-term long BTC position using idle capital from the first 20/20/60 take-profit if market conditions align.

Expected 2025 eToro Returns:

~50–70%.

Supporting Notes:

FED Rate Projections: Two 25 bps cuts, targeting a year-end rate of 0.5% (based on the December 2024 meeting).

ETF Flows: BTC net ETF inflows for 2024 reached 506.2K BTC (~9.7K per week).

Current US Holdings: As of January 9, 2025, the US holds 198K BTC.

I want to point out that both scenarios align with the principle that BTC thrives when supported by institutional interest, regulatory clarity, and strategic policymaking. However, timing matters less than recognising and reacting to these catalysts.

When paired with disciplined execution, these narratives lay the groundwork for another strong year.

2025 Outlook: Headwinds and Tailwinds

I want to remind you of something.

This time is not different.

When we anchor our decisions to this principle:

We don’t fall prey to FOMO or FEAR.

We stick to a strategy that accounts for all scenarios, ensuring we capitalise on every single bull market and walk away profitable.

Sure, if BTC goes to $500K this cycle like some crypto clowns estimate 👇🏽

I will miss some upside that I can capture on the way down using my bear market strategy. That is far better for me and my copiers than holding on for some arbitrary number that doesn’t come and then having the stress of watching our net worth vanish before our eyes and blaming “market manipulators” or poor “Brian”.

I can assure you, that if your crypto net worth was $1M one evening, you tucked yourself into bed, and then 8 hours later, you woke up to $900K - a loss of $100K in 8 hours or $12.5K per hour of sleep, the last thing on your mind will be

“OK - let me salvage what I’ve got so I don’t walk away empty handed”.

Oh, no. You (like everyone else) will be thinking

“OK - let it just go back to my previous ATH net worth and I’ll sell it all”.

But, the bull run is over. You won’t see your net worth climb to $1M for a long time, and so starts the painful waves of despair that come through in a bear market.

That’s why I prioritise discipline and long-term vision over chasing ATH net worth.

Back to my long-term view 👇🏽

Growth Focus:

economic resilience in the US and ‘US exceptionalism’ will extend into 2025, supported by strong GDP growth.

Crypto Resilience:

despite the strong USD and weak short-medium term global liquidity, I am fairly confident in a bullish 2025 due to the tailwinds ahead.

I’m bullish on long-term crypto adoption and innovation, particularly around L1s (SOL, BTC, SUI and XRP) and Decenetralised Physical Infrastructure (DePin).

Strong Q1:

historically, Q1 has been a strong quarter for BTC and risk-on assets.

while I expect volatility with BTC I believe we’ll see new ATHs in the first quarter.

Second Half Recovery:

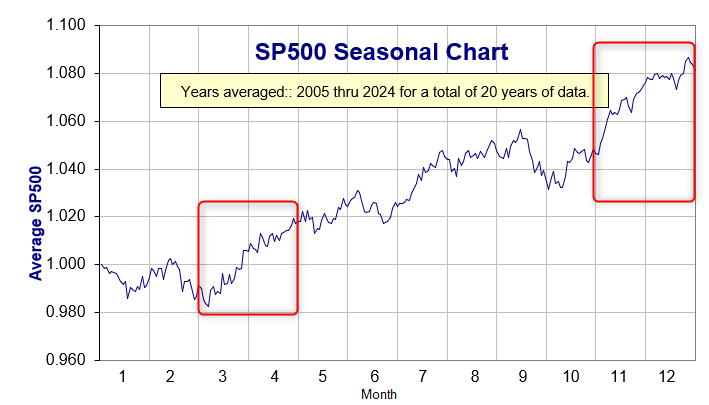

I expect a potentially weaker Q2 and possibly even Q3, with limited upside due to seasonality and narrative.

for example, in the last 3 cycles, 66% (or 2 out of 3) Q2 periods were negative for BTC

besides that, we’ve all heard the saying “sell in May and go away” for TradFi indices like the S&P500. Well, taking that one step further, over the last 20 years, we’ve seen most of the S&P500 performance coming in March to April and November to December.

a strong Q4 rebound is likely, based on narrative and historical ‘blow-off tops’ in cycle peaks - this does not mean I’m waiting for Q4 to TP. It simply means that if I’ve TP’d earlier, I will be looking for entries around this time for a short-term trade with clear invalidation levels.

Tailwinds:

I am expecting

Policy Shifts under Trump:

crypto-friendly regulation with clearer frameworks and new products like SOL ETFs.

continued institutional adoption and potentially by US states, countries and public companies adding BTC to balance sheets.

Liquidity and Innovation:

increased flows into BTC ETFs and SOL ETFs (potentially) and the Saylor BUY button may continue to drive crypto higher.

growing use cases for blockchain and crypto assets (think bank lending and DePIN)

Catalysts for Crypto Growth:

events like China resuming liquidity injections and the US ‘ReFi’ cycle could spur further demand for risk-on assets.

Headwinds:

Global Liquidity Reduction:

China's reluctance to inject liquidity to date amid a collapsing bond, real estate and equity markets remains a major concern. However, I expect this to be addressed within Trump’s first 100 days in office.

US Net FED Liquidity is still trending downwards, which has correlated well with BTC price action over the last 8 years.

the global liquidity pool has shrunk for the last two months adding headwinds to risk-on assets.

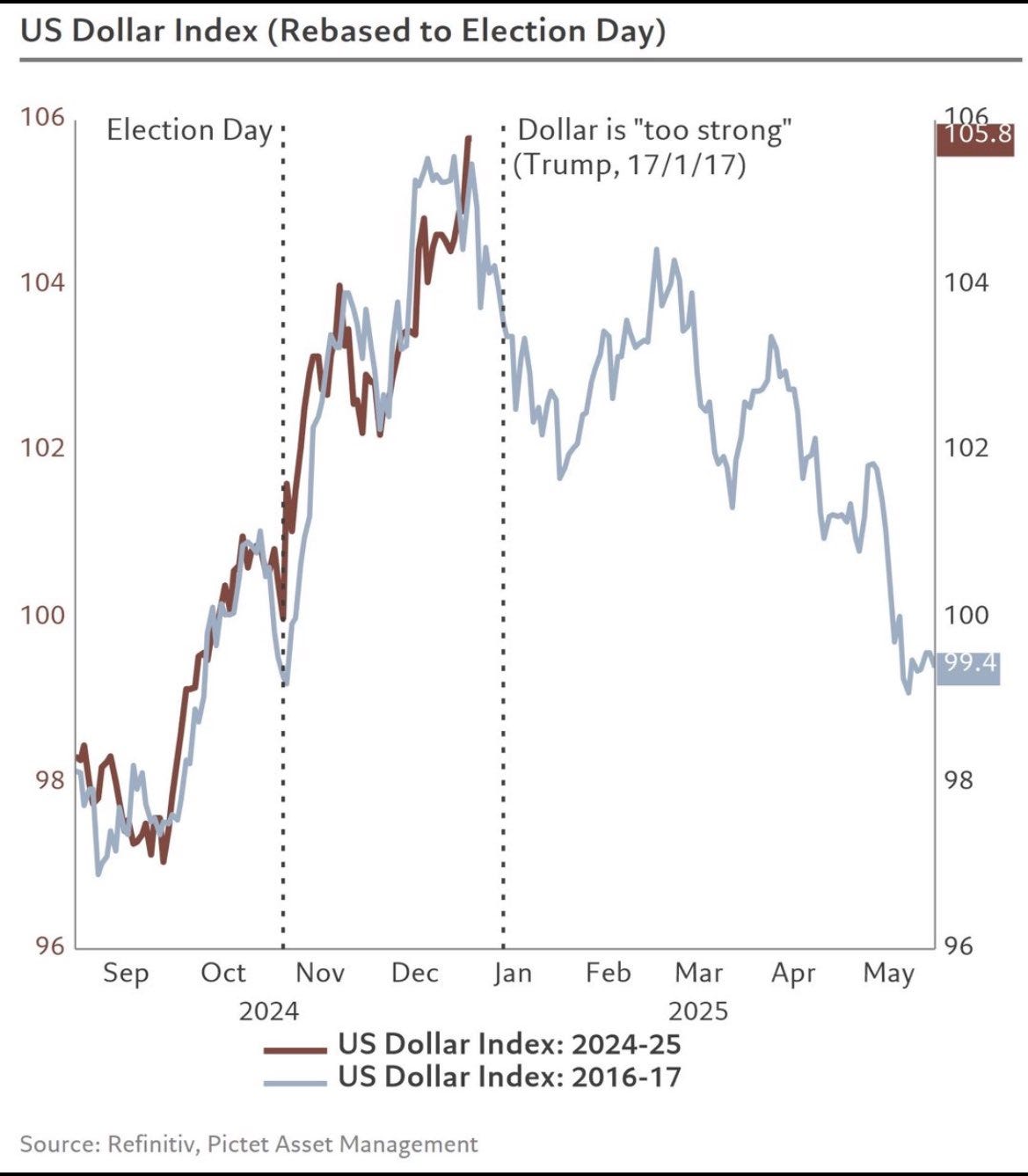

USD Strength:

A stronger dollar creates challenges for risk-on assets including BTC and equities. However, I expect Trump’s rhetoric and strategic measures to weaken the USD, much like 2017 👇🏽

Macro Risks and Sentiment:

potential disappointments regarding the SBR, regulatory clarity, or inflation metrics could stall momentum.

recessionary fears continue to make headlines and will stall growth if it becomes a reality.

By paying attention to these tailwinds and headwinds, my strategy remains adaptive and robust. My goal isn’t just to react but to anticipate shifts, ensuring my copiers and I continue to be positioned well into 2025.

2024 Portfolio Performance📉

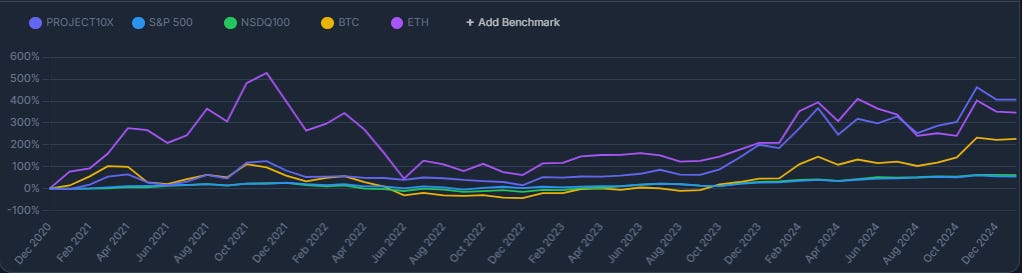

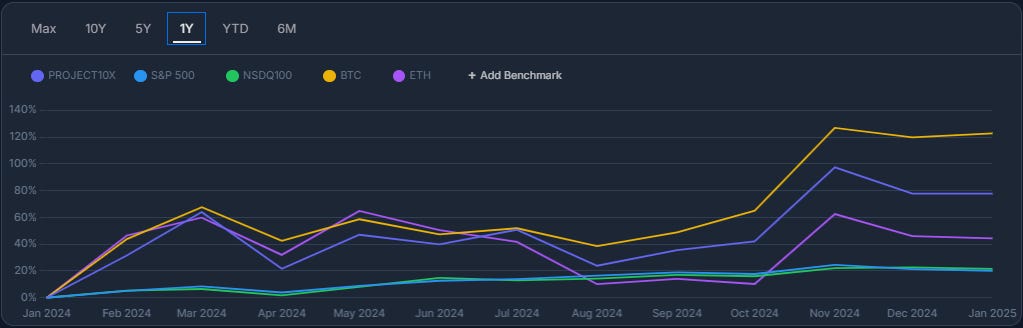

We finished 2024 with a 68% return and ~50% annualised since joining eToro in 2021.

As I said earlier, our goal is to outperform in the early stages of a bull market, and we did so, notching 160% in 2023.

The portfolio is outperforming all the relevant benchmarks (BTC, ETH, S&P500 and the NASDAQ) since joining eToro.

I would like to point out that while we have outperformed most benchmarks in 2024, we have not outperformed BTC.

But that is not my goal, nor am I concerned with outperformance on a year-on-year basis. The only thing that matters is that we outperform all benchmarks over an entire cycle, because that means our strategy is working. If we stop outperforming BTC or ETH over an entire cycle, then it is time to either

adjust the strategy; or

HODL BTC.

While there are things I wish to improve on in the next cycle, overall, I am satisfied with our 2024 performance given

✅ annualised returns are above our target goal 🎯

✅ we continue to outperform our benchmarks 💪🏽

Goal Tracking 📖

Background

I funded my eToro account with $3800 USD (~$5000 AUD) on 1 January 2021.

I need a 19% annualised return to turn a $3800 portfolio into $1M in 30 years.

If I achieve the required return, this portfolio will hit $1M by January 2051.

As of December 31 2024, we are 4 years and 8 months ahead of schedule.

This means that

if you invested $100K into BTC on January 2021 (when I joined eToro), you would have $324K.

if you invested $100K and copied my trades on eToro, you would have $507K.

If you’re thinking about copying my trades and want your eToro portfolio to reach $1M at the same time as this tracker, you would now have to copy with $19,243.

Or you could speed things up using a DCA strategy and make small monthly deposits.

Note, my actual eToro portfolio value is ~$96K given eToro has capital requirements I’ve had to adhere to as a Popular Investor on the platform.

If you decide to join eToro and copy my trades, follow the steps below to get yourself a FREE premium subscription to this newsletter to go along with it!👇🏼

This is not financial advice.

I’m just laying out the data because numbers are my love language

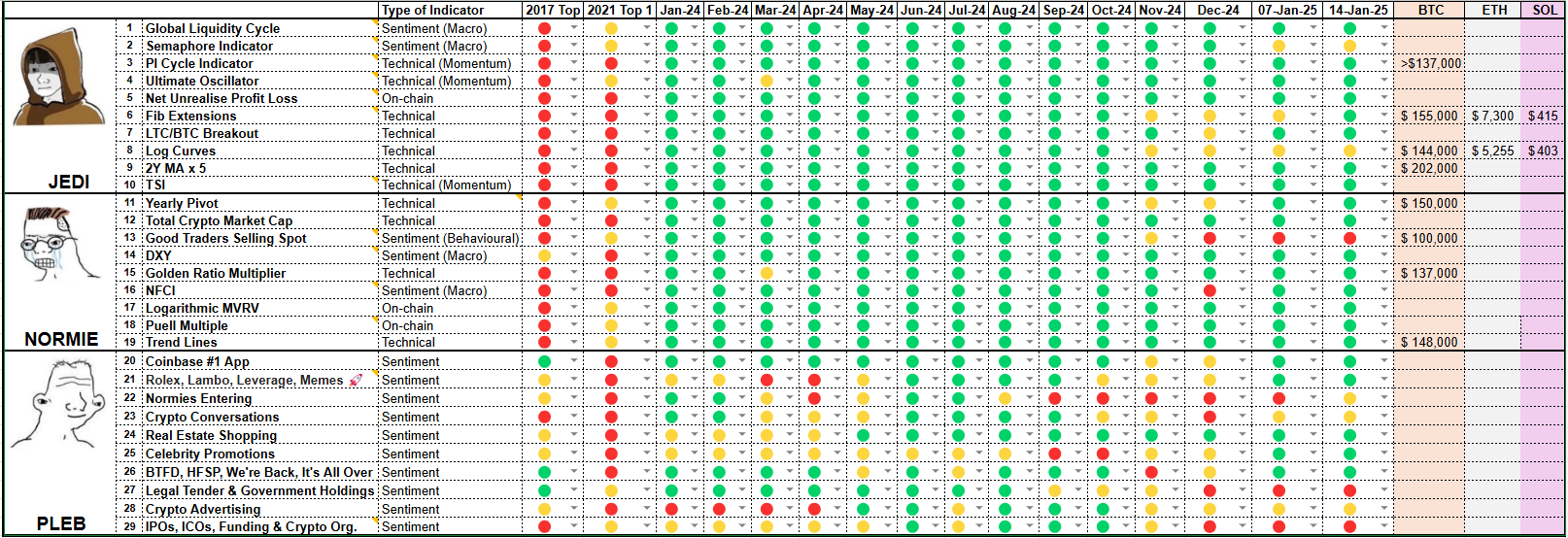

Now, let’s dive into the RORO tool to understand how we should be positioned for the next few months👇

Should we be risk-on? 👀

TL;DR: Trust the Data, Ignore the Noise

Here’s what the RORO tool is signalling👇

I’ll keep it short this week, because we covered the RORO tool in depth last week.

We’re still firmly in risk-on mode—unchanged since I started publishing the RORO tool publicly in September 2024 👇🏽

Remember, the RORO tool provides a multi-month directional outlook based on macro and crypto factors so that we’re not left doing this everytime a new piece of FUD or marginally relevant information comes out 👇🏽

Sure, BTC being sold by the US Government is a factor in price action (see line item #14), but it’s only one of fourteen macro and crypto factors to consider.

To give you an idea of why I use a RORO tool rather than my own degen ‘intuition’, since September 2024 we’ve had.

ongoing fears of the Yen carry trade unwind

US Election and ‘what it means for markets’

Tether FUD

South Korean Martial Law

the US Government Selling BTC FUD

and more

In that time, the tool has remained risk-on.

In that same time period (18 Sep 2024 to today), BTC is up 56% 👇🏽

and the crypto total market cap is up 57% 👇🏽

That is why we use back-tested quantitative data to inform our decisions.

Onto the STT indicators 👇🏽

Indicator Summary 🚦

TL;DR: No top signals in sight.

We’re not at the top. We’re not even close.

The technical indicators (see the last 3 columns on the right) back that up by estimating the BTC cycle top at $135 - $150K this cycle.

That’s all you have to know for now.

I’m not going to go into detail for fear of sounding like a broken record, because barely anything has changed since my in depth review last week.

If you have any questions, drop a comment!

Catch you next week.

✌🏽

Filip

Great content as always. These newsletters are becoming addictive 🙌

Thanks fil you really are succinct and educational in all you post!