Welcome 👋🏽

Here are some of my most important newsletters of 2025. If you haven’t read them yet, I highly recommend taking some time to go through them.

My SOL circuit breaker strategy, which ensures I don’t end up a “community member” in case markets turn on us (April 2025).

My SOL exit strategy. Need I say more?

The only macro data that matters is covered in this newsletter. Everything else is noise (April 2025).

My 2025 outlook, expected eToro portfolio returns, and base case for BTC (January 2025).

2025 Blueprint - Your 30 000 Foot View ✈️

I previously laid out my overarching blueprint in January 2025 - let's quickly recap👇🏽

Base Case: $130,000-150,000 per BTC

In this scenario, steady progress defines the year:

Strategic Bitcoin Reserve (SBR): The US holds its current BTC reserves (~198K) without further accumulation, establishing them as the nation’s SBR.

FED Policy: Two projected 25 bps rate cuts, aligning with the December 2024 FOMC projections.

Institutional Adoption: Corporate BTC purchases and ETF flows maintain their current pace.

Bull Case: $200,000+ per BTC

A more aggressive adoption cycle drives this outcome:

SBR Expansion: The US adopts an official SBR policy, aligned with the BITCOIN Act, purchasing 200K BTC annually for five years to build a 1M BTC reserve.

Accelerated FED Easing: Faster-than-expected rate cuts as core PCE inflation cools.

Adoption Surge: Corporate BTC adoption accelerates, supported by ETF flows, and a significant entity, be it a “MAG 7”, a US state, or a nation-state adding BTC to their balance sheet.

Market Structure Bill: The Digital Asset Market Structure (DAMS) Act passes, establishing a clear regulatory framework that closes gaps, protects consumers, and provides much-needed clarity for institutional adoption.

Stablecoin Bill: A regulatory framework for payment stablecoins is enacted, ensuring they are fully backed 1:1 by U.S. dollars or other high-quality liquid assets like Treasury bills. This increases trust, unlocks institutional capital, and further integrates stablecoins into the global financial system as a seamless bridge to Bitcoin and other digital assets.

📈 How Are We Tracking So Far?

SBR: The definitive trajectory for the SBR will become clearer after July 2025, following the Treasury’s evaluation report and insights from the Presidential Working Group on Digital Asset Markets.

FED Policy: Markets have already priced in three rate cuts by year-end, surpassing my initial conservative base case expectations.

Institutional Adoption: Corporate BTC adoption and ETF inflows remain robust. However, we've observed an accelerating trend of public companies following MicroStrategy’s playbook by issuing convertible bonds for BTC purchases:

➡️ MARA Holdings (Nov 2024)

➡️ Bitdeer Technologies (Nov 2024)

➡️ GameStop (Mar 2025)

➡️ Strive Asset Management (May 2025)

We also have two US states that have officially greenlit BTC holdings for their balance sheets.

To add fuel to the fire, CZ Binance has indicated multiple nation-states are actively exploring their own BTC reserve strategies.

Market Structure Bill: The DAMS draft bill is actively progressing through legislative discussions.

Stablecoin Bill: However, the GENIUS Act (stablecoin legislation) recently stumbled in its initial Senate vote.

📌 Summarising Our Position

Taking a 30,000-foot view, while significant milestones remain, the scale is marginally tipped towards our bull scenario for 2025.

This initial lean shapes our primary bias:

👉🏽 Target the upper range of the base case (~$150K BTC), while keeping our views dynamic. If the other pieces fall into place, we could go even higher.

Institutional & Retail Estimates

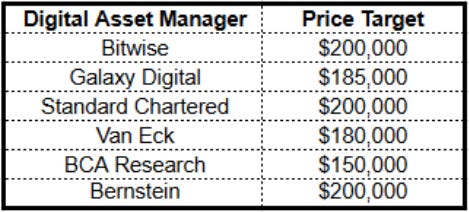

📊 Institutional Estimates

I've said it before, and I'll keep hammering it home: we identify where institutional fund managers and analysts set their BTC targets, and then we stay well away from those numbers.

Why? Because these targets quickly become consensus due to their massive media reach, and as we’ve learned repeatedly, the consensus rarely pans out.

Remember the 2021 consensus?

BTC to $100K

ETH to $10K

SOL to $700

Some folks are still HODLing their 2021 bags to this day, courtesy of listening to the consensus view….

👥 Retail Estimates

I've also been closely tracking BTC predictions on X. Here are some notable examples.

$214K BTC, 114K views

$288K BTC, 713K views

And my personal favourite - this guy just decided “fu** it, we ball” and dropped a $500K BTC target… because why not? (100K views)

As Raoul Pal says, “everyone’s hopes and dreams are riding on this” - if that’s the case (which it is), then it makes sense why folks are slapping these sorts of price targets on BTC.

BIG target = eyeballs = social media clout = $$

This is not to say that I’m not bullish on BTC - I am. In fact, roughly 8% of my public eToro portfolio is BTC.

I was vocal and allocating even when MSM and social media were busy calling BTC to $50K BTC.

But clarity is key, and we must remain rational.

Want a lambo? Cool. You’ll get one… eventually. Maybe not this cycle, but remember the famous quote..

“good Lambo come to those who wait”

- Confucious

My intern (bless his soul 🙏) has diligently sifted through social media for weeks. After reviewing 829 posts on X, here's how the "normie" BTC price predictions stack up:

✅ The Good News: About 53% cluster around a cycle high of $150K–$250K.

❌ The Bad News: Nearly a quarter (~22%) predict BTC won't surpass $150K.

This sentiment will likely shift as BTC continues its upward momentum, but for now, here’s where we stand:

Institutional Players: $180K+

Retail (“Normies”): $150K–$250K

Key Opinion Leaders (the "Specials" like Bob Loukas): $200K+

🎯 Our Second Bias

👉🏽 A BTC price target below $150K ensures we are not aligned with the herd, normies, and institutional estimates.

Technicals

📐 Measured Moves

Taking the measured move from just before the breakout after Trump's election win..

and overlaying it onto BTC’s first major rally in 2024 shows good alignment with the March 2024 local top.

Overlaying this same move on current price action points us toward a BTC target around ~$140K.

Will it stop exactly there? Who the f*** knows - but there’s a clear pattern forming around the psychological $150K level, and markets have a well-known bias towards nice round numbers. If nothing else, we can safely assume $150K is significant resistance.

📖 Order Books

Preface: Order book insights generally serve best for short-to-medium-term trading. I still want to know where whales have historically parked their sell orders.

Looking at Binance Perps’ heatmap for SELL orders ≥100 BTC from when BTC last hit ATHs, there's a sell wall at $120K–$125K.

The SPOT market heatmap (≥82 BTC positions) similarly clusters around the $120K–$130K region.

If you're planning to take profits soon, front-running these clustered areas makes sense - not necessarily because they'll hold indefinitely, but because they represent substantially stronger resistance compared to levels like $115K, where no significant sell walls historically existed.

📈 PI Cycle Indicator

Given the historical accuracy of the PI Cycle Indicator (which has nailed the tops for three consecutive cycles)…

we could anticipate a cycle peak above $157K, with the white moving average trending upwards.

📏 Fibonacci Extensions

Long-term Fib extensions:

1.618 Fib → $102,000

2.618 Fib → $155,000

Medium-term Fib extensions:

1.272 Fib → $118,000

1.618 Fib → $131,000

Remember: BTC previously tagged just below the medium-term 2.618 Fib during February 2024, highlighting the reliability of this indicator.

📉 Logarithmic Curves

Current logarithmic growth curve price targets sit at:

$103,000

$160,000

🎯 Yearly Pivot Levels

Potential resistance levels via yearly pivots:

R1 = $122,000

R2 = $150,000

🌀 Golden Ratio Multiplier

Historically, BTC hits one band lower each cycle. In 2021, it touched the purple band. For the current cycle:

Conservative target: Green band at $128,000

Aggressive target: Red band at $157,000

🗃️ Estimate Summary & Cluster Buckets

Compiling all technical insights above into clear confluence zones ("cluster buckets") helps visualise key resistance levels:

📌 My Perspective and TP Strategy

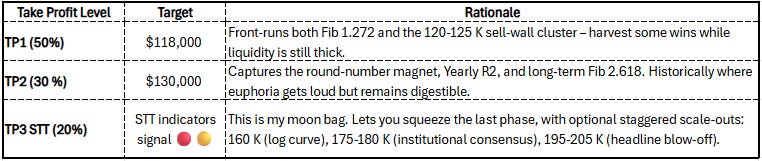

Based on the above, my updated TP levels at this stage of the cycle are as follows.

Let me provide some perspective as well.

I've consistently estimated BTCs peak at around $135K–$150K, with my current best guess sitting at $142,500. Even selling the first tranche at $118K places me within a respectable ~21% of a potential ATH - very much a win in my book.

Think of it this way: if someone exited BTC completely at $55K during the last cycle, missing the top at $69K, they'd still have done a great job after the drop to $16,500.

The second thing to consider is the tax implications. How much capital gains tax will you owe? Would it be worthwhile to sell if BTC hits $150K and then crashes -40%, -50%, or even -60%? Your personal answers to these questions should guide your selling decisions. I only say this for BTC as it is special and deserves special consideration - every other digital asset is fundamentally a sh**coin and should be treated as such.

Finally, a personal note: My wife and I are currently working through the logistics of a permanent overseas move. Given Australia's "exit tax," we're essentially forced into a strategic sale of all assets. The moment you cease to be an Australian tax resident, the ATO treats it as if you've liquidated every CGT asset at market value. Instead of passively accepting taxation at that valuation, I'm proactively timing asset sales to optimise returns.

The final 20% of my BTC position stays on the ride until the STT indicators signal an exit. That said, I try to plan for every scenario, and there’s a non-zero probability the STT indicators could flash before TP2. If that happens, which isn’t my base case, I’ll adjust accordingly and offload the remaining 30% + 20% of my BTC bag at that time.

Flexibility is key, but for now, this is the plan.

Circuit Breakers

That's the plan - but what if things don't go as planned?

Well, for that, my friends, we use circuit breakers (CBs). These are essentially our “get-the-f***-out-of-the-position” triggers. When a CB activates, we sell. Simple as that.

🚨 CB1: Market Structure

Flashback to February 2025: my weekly CB triggered at $89,300 BTC. My original plan was to wait for the bounce and exit my BTC positions. However, shortly thereafter, POTUS announced the SBR, closing BTC above the critical weekly level and invalidating my CB - at least temporarily.

As it turns out, the POTUS announcement turned out to be a complete nothingburger, and coincided with escalating tariff tensions. Lesson learned. I’ve since refined this strategy to ensure simplicity above all else:

If the CB triggers, you exit - no exceptions.

Currently, the CB trigger sits at $93K on the daily (D1) timeframe. If BTC breaks below this, I’m out immediately. 👇🏽

🚦 CB2: Megatrend Indicator

Community chat regulars will know my intern and I have been backtesting the Megatrend Indicator to determine its effectiveness as a circuit breaker. The results are in - and they’re solid. Not only is the Megatrend indicator valid as a CB, but we’ve improved it, too. I'll publish the full backtest results once market conditions stabilise a bit.

The rule here is equally straightforward:

The indicator recently flipped to a BUY signal.

When it flips back to a SELL signal, we exit immediately.

Again, absolutely no ifs, buts, or maybes.

And there you have it - my updated TP and CB strategies for BTC.

Next, let's dive into the RORO tool.

Risk-On Risk-Off (RORO) Tool

Take a look at the line items in our RORO tool - why the f*** people are bearish is beyond me…

Reviewing Our Key Macro Factors from April:

In April, we clearly outlined what was necessary for #numbergoup

✅ Tariff progress (clarity and stability for the market)

✅ Declining inflation (giving the FED clear runway for rate cuts)

✅ Declining US 10-Year Yields (as repeatedly highlighted by the Treasury Secretary - crucial for reducing Government borrowing costs)

✅ Increasing global liquidity (the primary driver for risk-on assets)

✅ Decreasing geopolitical risks (markets love calm waters)

✅ Improving market sentiment (key for both retail and institutional capital inflows)

Every single factor has fallen neatly into place - again, why the hell anyone is bearish is beyond me.

Additional Macro Context:

To further solidify our perspective, the GDPNow forecast has recently flipped positive for Q2. This directly counters the narrative pushed by macro doomers, who previously cited recession fears alongside tariff-induced inflation as drivers for why 2025 would be a sh** year.

For the record, my preferred real-time inflation indicator, Truflation, currently stands at a ‘barely alive’ 1.58%.

Sorry macro doomers - medium-term indicators strongly suggest you were...

and as a final LOL, bankers were slashing their January 2025 S&P500 estimates at the lows in April… only for markets to rip in their face.

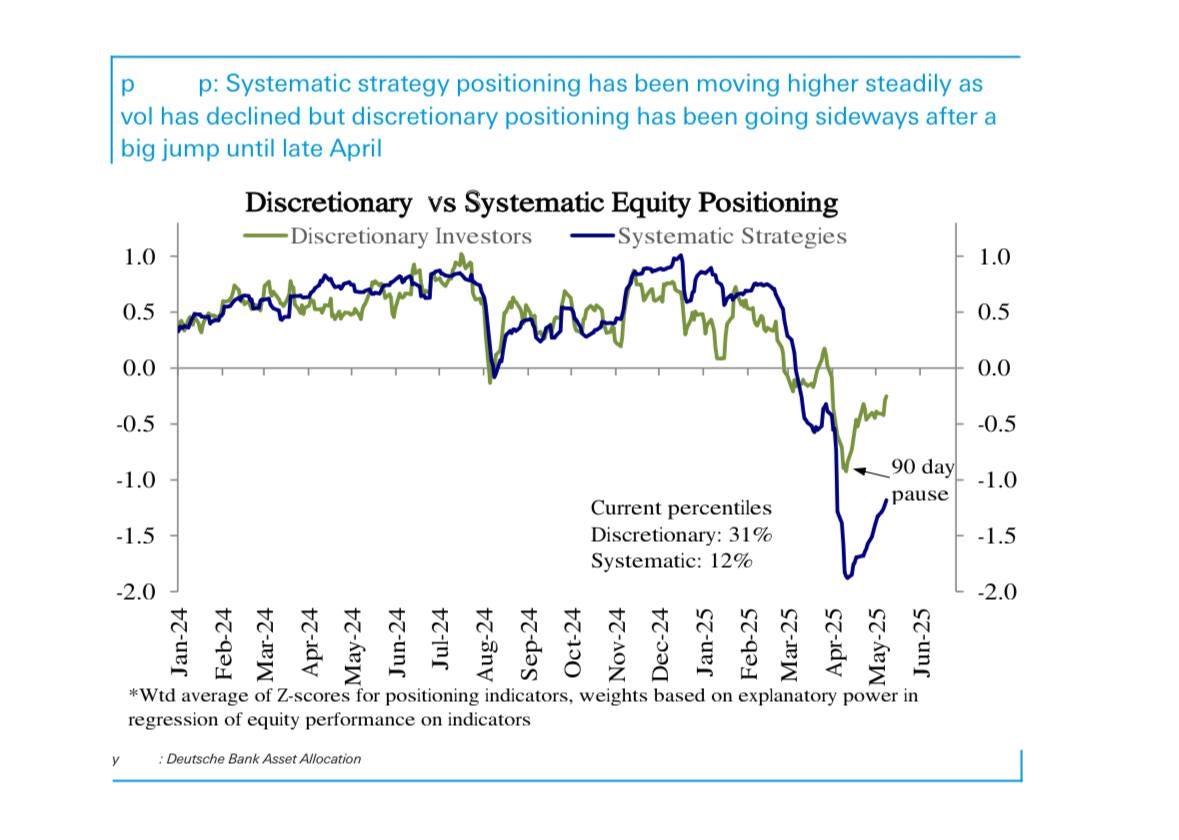

all while systematic traders (i.e. hedge funds) have been sidelined for much of the move..

Watching the DXY Level:

One crucial factor I'm monitoring closely is the key support level for the DXY- a level I've highlighted consistently since the start of the bull run.

Look at how well BTC performed during the current DXY breakdown. If the USD continues weakening, BTC (and the broader crypto market) will likely continue to rip higher.

To top it off, we’ve even got the equity markets back on track with bullish market structure - we’re putting in higher highs (HH) and higher lows (HL).

My high-level macro thoughts can be summarised as…

Selling the Top (STT) Indicators🏎️

We’re at that point again - it’s time to start paying attention to our STT indicators.

Things are starting to pick back up.

A reminder, that this tool is there to help us sell near the top by flashing 🟡 and 🔴 warning signs like the last three major local tops shown below 👇🏼

While we’re not there yet as shown by the plentiful 🟢 on 13 May 2025. Perhaps we are still several months away - however, it is inevitable that as BTC and total crypto market cap gain momentum, we will see the signals start turning from 🟢 to 🟡and finally 🔴.

That's all for now!

✌🏽

Filip Brnadic

Honestly, this is really complete analysis on the things that actually matter.

Is the MegaTrend indicator part of the RORO or STT? Also, can you share the script for this in TradingView with us?