The End of Easy Gains

Why the usual playbook no longer works, and where I'm looking at next.

Welcome 👋🏽

This week we cover 🗞️

Quantum Leap: AI and Quantum outperform crypto majors - is it time to diversify?

Geopolitical Noise? Why the Israel-Iran conflict might not affect your bags.

Risk-On or Chill? What our RORO tool suggests about current market conditions.

Sell Signals Check: STT indicators update - is the bull run over?

What you may have missed 💡

It’s time, ladies, gentlemen, and fellow degens.

Starting next week, I’m dropping a 4-week series on bear market strategy.

We may not see a bear market for another 12 months, but it pays to be prepared.

If you haven’t already got a playbook where you journal, strategise, and document your learnings, then you should probably get started, as this series should slot right in.

I use Confluence, but you can just as easily use OneNote, Microsoft Word, Notion, Evernote etc.

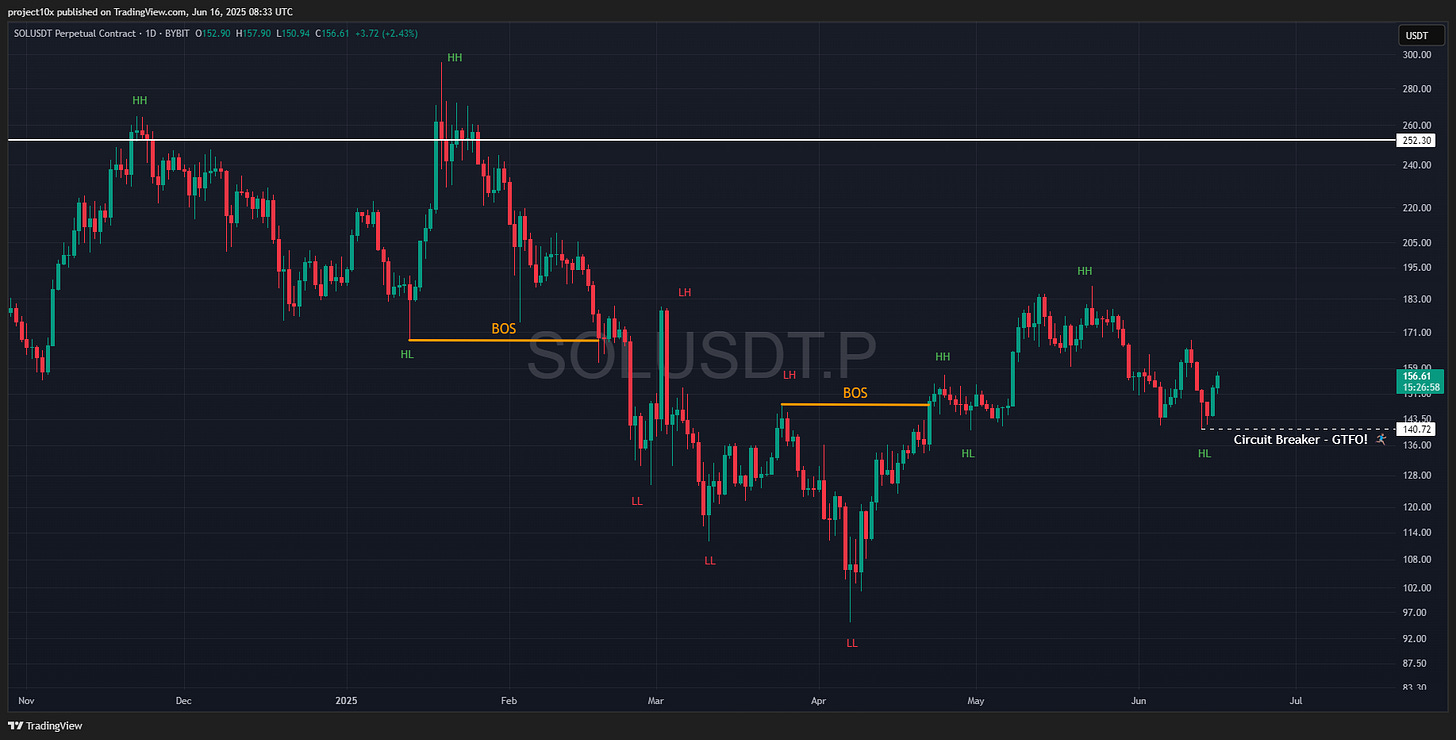

For most of this week, I’ve been thinking about my biggest holding - SOL.

We’ve had a strong bounce off the 13 June lows.

I believe we’ve bottomed purely on the basis that:

S&P 500 and NASDAQ have barely reacted on Israel-Iran escalation

BTC and ETH have not broken market structure.

When euphoria returns to the sh**coin market, I am expecting a reclaim of the 0.17 level on the SOL/BTC chart and the 0.26 resistance level to be tagged near the top of the bull run.

SOL/ETH is less clear, but perhaps a run to 0.07 is likely.

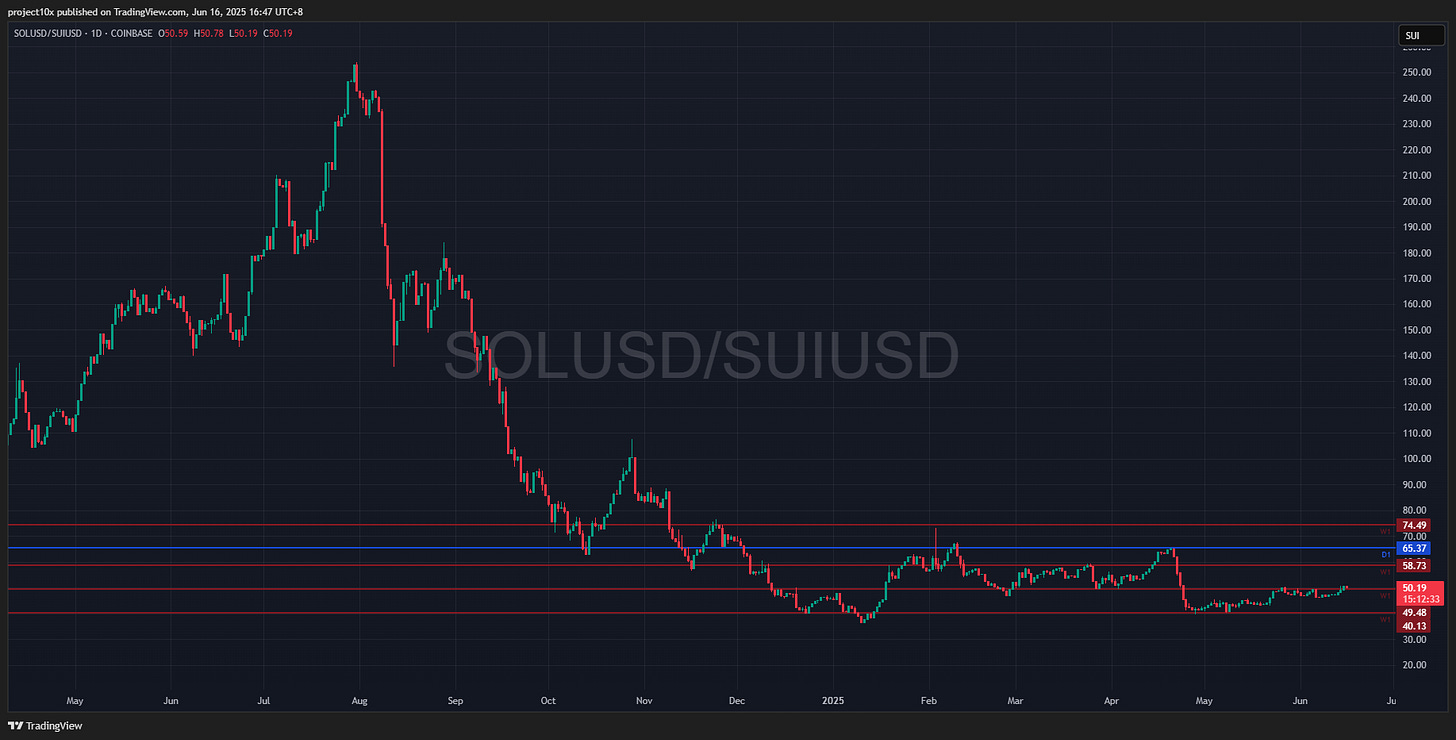

SOL/SUI has been putting in lower highs (LH) and lower lows (LL) since August 2024, and while I don’t expect anything to change, a reclaim of the 65 level is required to change from bearish to bullish market structure.

The reason I’ve been thinking about this is that I believe we are at a stage of maturity in crypto where the majors aren’t necessarily the best risk-reward plays all the time.

That doesn’t mean allocating more to sh**coins; it means that there are other asset classes we should also consider.

has been quite vocal about the AI and Quantum sectors, with clear outperformance from some of the thematic assets from the April lows.For perspective from April 2025:

BTC is up 44%

ETH is up 89%

SOL is up 65%

SUI is up 82%

Meanwhile, in TradFi land, CoreWeave (CRWV) is up 339%

D-Wave Quantum (QBTS) is up 166%

Quantum Computing (QUBT) is up 195%

IONQ is up 101%

IREN is up 96%

The list goes on, but my point is that if our strategy is “exposure to risk-on assets”, then we need to consider all assets, especially those with a strong narrative (AI and Quantum computing).

I haven’t made any plays, and I don’t intend to move things around. I’m just putting it out there now, because we will inevitably get a bear market, and when we do, don’t be surprised to see a 5% allocation to a sh**coin equivalent in the Quantum space, or a 20% allocation to an AI TradFi equity from me. For now, I watch and study 💪🏽

Now, let’s get into how our Risk-On Risk-Off (RORO) tool says we should be positioned 👇🏽