How We Play The Next 6 Months

Why Q1 2026 could be the moment retail gets trapped, and how we’ll use it to compound.

Welcome 👋🏽

Ladies and Gentlemen,

It’s with great pleasure that I announce:

Our strategic playbook for the past month has executed exactly as intended.

To recap:

the take-profit (TP) strategy I laid out for BTC and SOL, and executed in September, worked to perfection [🔗], [🔗], [🔗]

sitting on the sidelines through “Uptober” while preparing for the Kingmaker trade was the right call.

repositioning ahead of consensus gave us the edge that most of the market failed to see.

and, as always, we’ve learned from what didn’t go perfectly, because refining strategy is what separates professionals from participants.

Now, as we close out 2025, it’s time to enjoy the fruits of our execution. Trump’s administration is signing trade deals across Australia, Malaysia, Thailand, Cambodia, India, and most importantly, China, setting the stage for a macro backdrop that continues to favour risk assets.

Strap in. Where we’re going, a space helmet is required. 🚀

Must Reads 📚

If you’re new here, check these out 👇🏽

How much do you really need to retire? [🔗]

How I view investing vs buying a home [🔗]

Our Money Rules [🔗]

Life Dinner: monthly sitdowns with your partner, you’ll actually want to have [🔗]

BTC: Should I HODL or should I SELL? [🔗]

How much of a drawdown can we expect in BTC during a bear market? [🔗]

State of the Crypto Market 🤓

I’m on the move over the next two weeks.

Right now, I’m in Limassol, Cyprus for the Popular Investor Conference. Next week, I’ll be in Dubai, UAE, for a scoping trip - exploring schools, suburbs, and deciding whether to make a permanent move.

If you’re in either city and want to catch up, shoot me a DM and let’s grab a coffee ☕

Now, let’s get right into it.

Over the past few weeks, I’ve been repositioning idle capital following the liquidation cascade on 10 October 2025, based on the view that we’d soon get clarity around three major catalysts:

1️⃣ the China–US trade deal

2️⃣ the US government shutdown

3️⃣ the inevitable shift toward rate cuts and the end of quantitative tightening (QT).

Clarity on these fronts fuels risk assets, so that’s exactly where our focus has been.

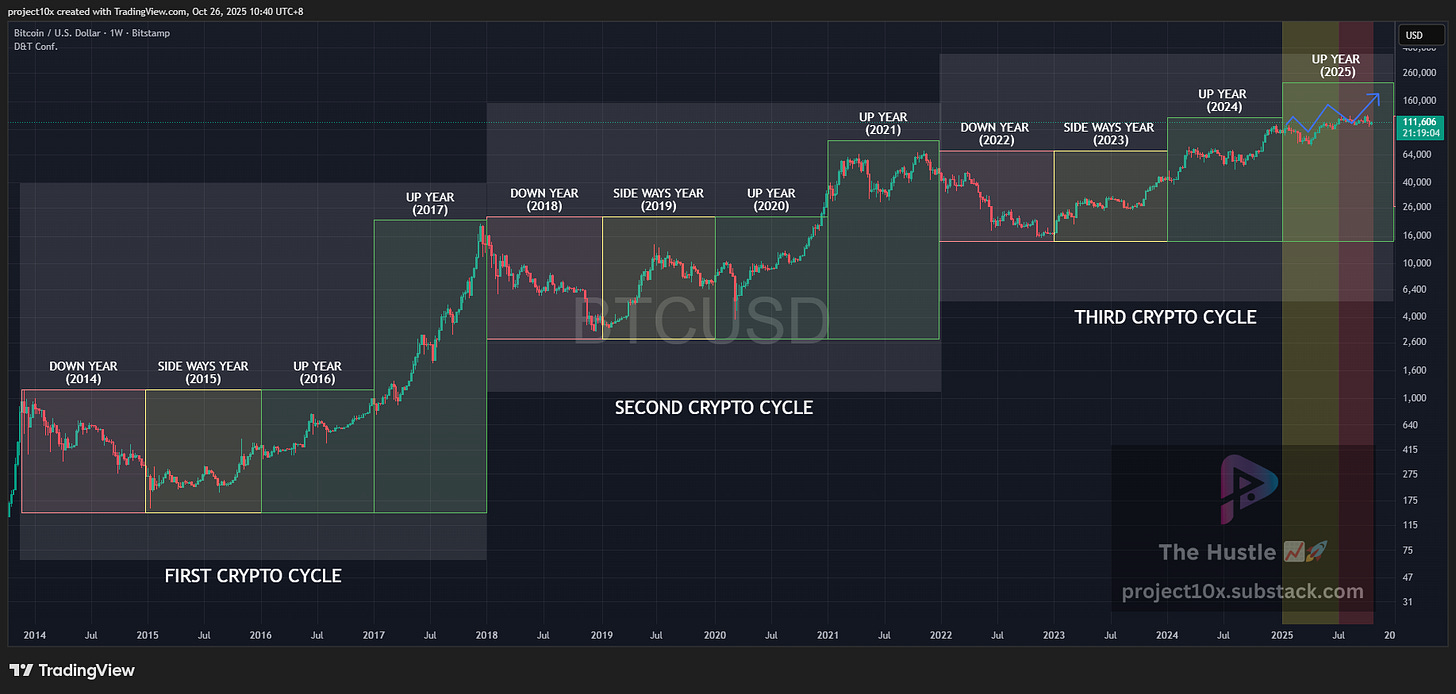

Lately, I’ve been thinking a lot about one of the market’s longest-running narratives. The 4-year crypto cycle. The theory goes that each BTC halving halves the block reward every 4 years, reduces new supply, and setting off a bull market over the next 12–18 months.

Investors use it to time their entries and exits across the entire crypto market.

However, there is also a glaring omission - there is only a sample size of 2 cycles (perhaps 3, if you count the first one). If we ask any statistician about their views regarding using a sample size of 2 to make investment decisions, we’d be laughed out of the room.

In our own framework, we track the 4-year cycle using STTI #2 - the Semaphore Indicator, which tends to flash SELL signals toward the end of the second “up” year of the cycle, right when believers think the top is in.

My view is that this belief (of the 4-year cycle) is mostly psychological reflexivity, not economic truth. Crypto doesn’t move because a clock ticks every four years. It moves because macro and geopolitical conditions either fuel or starve risk.

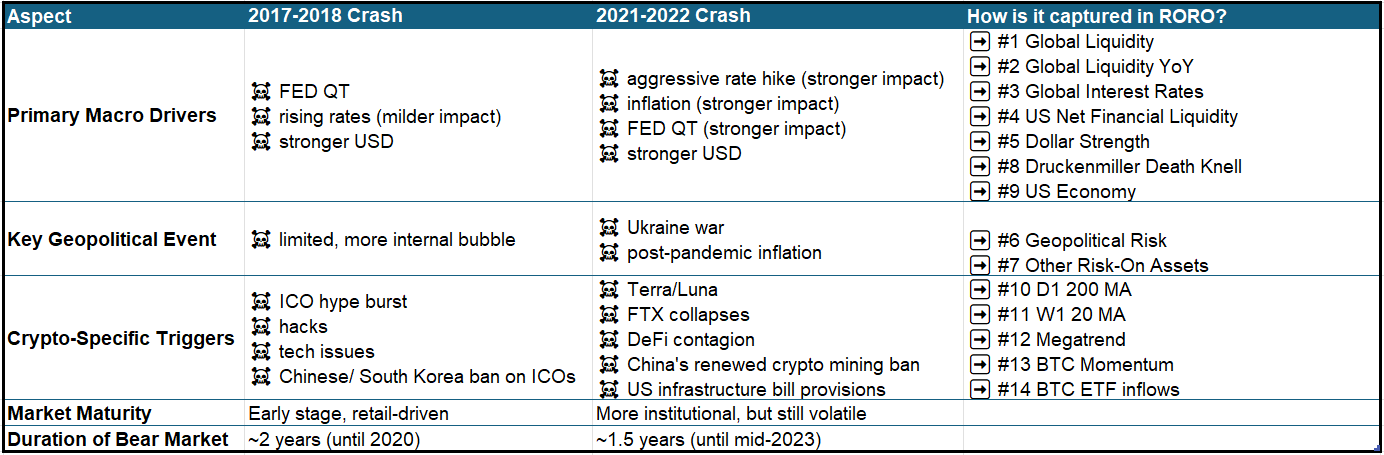

The last two bear markets weren’t triggered solely by the 4-year cycle. They were triggered by macro shocks i.e. tightening liquidity, rate hikes, and geopolitical stress. Those drivers are captured perfectly in our Risk-On Risk-Off (RORO) tool, which cuts through the noise and measures what’s actually driving capital flows.

That said, the 4-year cycle still matters in one key way: it shapes behaviour. Time becomes a valid lens not because it determines outcomes, but because belief shapes behaviour, behaviour shapes price, and price reinforces belief.

Historically, crypto topped in Q4 2017 and Q4 2021, while the NASDAQ kept pushing higher into 2018. It didn’t do the same in 2022, given that the US Federal Reserve (FED) initiated the fastest rate-hiking cycle in decades on the back of inflation ripping higher.

That divergence tells us that (barring market shocks like the fastest hiking cycle in decades) the reflexivity is real - crypto moved because the crowd expected it to.

When we zoom in on late 2018, we see why equity markets ultimately turned lower (almost a year later than crypto):

the FED continued tightening conditions, hiking rates in March, June, September, and December 2018.

the US vs China trade war escalated, creating global supply-chain uncertainty.

tech earnings took a hit, with chipmakers like NVIDIA cutting guidance in Q3.

That trifecta ultimately drove equities lower - a completely different backdrop to what we see today.

So, when would I expect a 4-year cycle to be broken?

Sometime in Q1 2026. This means that I expect those (normies) who sold in Q4 2025 or who believe the end of the crypto bull run is in Q4 2025 to start repositioning sometime in Q1 2026 as they begin to think the “supercycle is real”.

For those who aren’t aware of the “supercycle” 👇🏽

The crypto supercycle narrative suggests that instead of following the usual four-year boom-and-bust pattern, crypto will enter a prolonged, accelerating growth phase driven by mainstream adoption, institutional inflows, and structural liquidity expansion.

This is where our strategy comes into play.

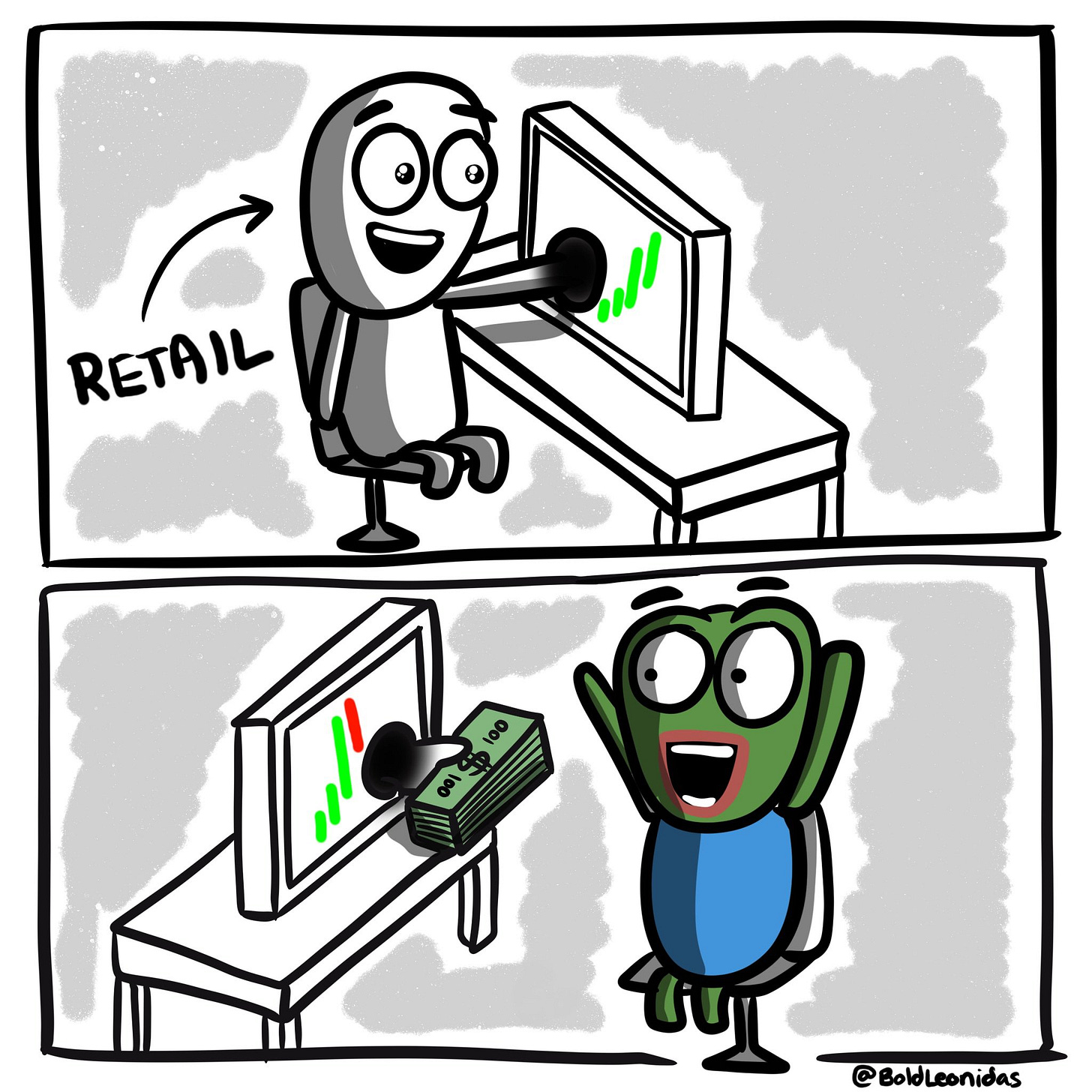

Remember what I’ve said all along - retail investors (“normies”, “the herd”, “the consensus traders” - whatever you want to call them) often do not make money in markets.

From my perspective, the “max pain” trade for them (and our biggest opportunity) would look like this: